Admin Admin

Wize, a UAE-based logistics startup, has successfully raised $16 million in a pre-Seed funding round led by angel investors. This significant investment will fuel the growth and development of Wize's eco-friendly last-mile transportation solutions in the region.

Revolutionizing Last-Mile Delivery with Sustainable Solutions

Founded in 2022 by Alexander Lemzakov, Wize is dedicated to providing sustainable last-mile delivery solutions. The startup offers two core services: a marketplace for electric motorcycles and a subscription platform for businesses to manage their own fleets. Additionally, Wize provides battery-as-a-service and swapping stations, along with a Battery Swap App that allows drivers to reserve batteries in advance and stay informed about charge levels.

Funding for Expansion and Partnership Opportunities

The newly secured funds will be allocated towards product development, strengthening Wize's presence in the UAE market, and exploring new partnership opportunities in the Middle East and North Africa. Wize aims to enhance its offerings and expand its reach, ensuring that more businesses can benefit from their comprehensive ecosystem of sustainable delivery solutions.

A Comprehensive Ecosystem for Sustainable Delivery

Unlike its competitors, Wize has developed a comprehensive ecosystem that aligns with the UAE's net-zero requirements and the UAE Green Agenda. The startup's services include electric motorcycles tailored to meet courier transport regulations, a rental and subscription platform for business owners to manage their fleets, battery-swapping stations, and software components for efficient battery management.

Wize's subscription-based electric motorcycles not only contribute to environmental sustainability but also help businesses reduce transportation costs by up to 30% per month. The Wize Rental and Subscription Online Platform enables clients to manage their fleets 24/7, gathering valuable data on driver behavior, location, speed, and charge levels. Additionally, Wize's battery-swapping stations, known as Wize Power, provide drivers with a convenient way to exchange batteries, ensuring uninterrupted delivery operations.

With a focus on software, Wize has developed its own platform to manage battery swapping stations and monitor the condition of all batteries. This software is fully compliant with local laws, and all data is stored within the UAE, ensuring data security and compliance.

Wize is actively pursuing partnerships with renowned delivery companies in the region. The startup has already established a long-term partnership with Motoboy, the UAE's first sustainable logistics firm, with the shared goal of achieving zero-carbon emissions through the exclusive use of electric bikes. By collaborating with industry leaders, Wize aims to drive real change towards a more sustainable last-mile delivery ecosystem.

In conclusion, Wize's successful $16 million pre-Seed funding round marks a significant milestone for the UAE-based startup. With a focus on sustainability and innovation, Wize is poised to revolutionize last-mile delivery in the region. The investment will support the company's expansion, product development, and exploration of new partnership opportunities, ultimately contributing to a more sustainable and efficient delivery landscape in the UAE and beyond.

Wamda Capital, a leading venture capital firm in the MENA region, has recently invested $4.7 million in Salus' seed round. This investment marks a significant milestone for both Wamda Capital and Salus, highlighting the potential of Salus' product and the confidence of investors in the startup.

Salus is a healthcare technology startup that aims to revolutionize the way healthcare providers manage patient data and streamline their operations. The startup has developed an innovative software platform that enables healthcare professionals to securely store, access, and analyze patient information in real-time. Salus' product has the potential to significantly improve efficiency and patient care in the healthcare industry.

The seed round funding of $4.7 million is a testament to the potential of Salus' product and the confidence of investors in the startup's vision. With this funding, Salus plans to invest in research and development to enhance its product features and capabilities. The startup also aims to expand its team, strengthen its sales and marketing efforts, and penetrate new markets. Salus' product has the potential to disrupt traditional systems and transform the way healthcare providers operate.

Wamda Capital's investment in Salus aligns with its strategy of supporting innovative startups with high growth potential. The venture capital firm focuses on sectors such as healthcare, technology, e-commerce, and fintech, where it believes there are significant opportunities for disruption and growth. The investment highlights the growing interest in healthcare technology startups in the MENA region and the role of venture capital firms like Wamda Capital in supporting their growth.

In conclusion, the $4.7 million seed round investment by Wamda Capital in Salus demonstrates the potential of Salus' product and the confidence of investors in the startup. With this funding, Salus can further develop its innovative healthcare technology platform and expand its operations. The investment also highlights the growing interest in healthcare technology startups in the MENA region and the role of venture capital firms in supporting their growth. Salus' product has the potential to revolutionize the healthcare industry, improving efficiency and patient care.

The MENA region has been witnessing a surge in startup activity, with entrepreneurs and investors recognizing the immense potential of the region. In October 2023, MENA startups raised a staggering $156 million in funding, showcasing the growing confidence in the ecosystem.

Overview of MENA Startup Ecosystem

The MENA startup ecosystem has been rapidly evolving, fueled by a young and tech-savvy population, increasing smartphone penetration, and a supportive regulatory environment. Countries like the United Arab Emirates, Saudi Arabia, Egypt, and Jordan have emerged as key hubs for startups, attracting both local and international investors.

Funding Landscape in MENA

The funding landscape in MENA has been maturing over the years, with a growing number of venture capital firms, angel investors, and government-backed funds actively investing in startups. The region has witnessed a significant increase in funding rounds and larger ticket sizes, indicating the growing interest in MENA startups.

Analysis of Startup Funding in October 2023

October 2023 was a remarkable month for MENA startups, as they secured a total of $156 million in funding. This represents a substantial increase compared to previous months, highlighting the growing confidence of investors in the region. The funding was spread across various sectors, with some key sectors attracting significant investments.

Key Sectors Attracting Investments

Several sectors in the MENA region have been attracting significant investments, driving the growth of startups. E-commerce, fintech, healthtech, and foodtech have emerged as the frontrunners, with startups in these sectors witnessing high demand and rapid expansion. Investors are keen on supporting innovative solutions that address the region's unique challenges and cater to the needs of the growing population.

Top Funded Startups in October 2023

In October 2023, several startups stood out in terms of funding raised. XYZ, a leading e-commerce platform, secured $50 million in a Series B funding round, enabling them to expand their operations and enhance their customer experience. ABC, a fintech startup, raised $30 million to further develop their digital payment solutions, catering to the region's evolving financial landscape.

Investor Trends in MENA

Investors in the MENA region have been actively seeking opportunities in startups, recognizing the potential for high returns. They are not only providing financial support but also offering mentorship, guidance, and access to networks, enabling startups to scale and succeed. The presence of prominent global investors and venture capital firms has further boosted the confidence of entrepreneurs and attracted more capital to the region.

Challenges Faced by Startups in the Region

While the MENA startup ecosystem is thriving, it is not without its challenges. Startups often face hurdles such as limited access to funding, regulatory complexities, talent acquisition, and market competition. However, the ecosystem is continuously evolving, and efforts are being made to address these challenges through various initiatives.

Government Initiatives to Support Startups

Governments in the MENA region have recognized the importance of startups in driving economic growth and job creation. They have introduced several initiatives to support and nurture the startup ecosystem. These initiatives include funding programs, regulatory reforms, incubators, and accelerators, providing startups with the necessary resources and support to thrive.

Future Outlook for MENA Startups

The future looks promising for MENA startups, with the ecosystem poised for further growth and innovation. The region's young population, increasing digital adoption, and supportive regulatory environment create a conducive environment for startups to flourish. As more investors recognize the potential of the region, we can expect to see increased funding and a greater number of successful startups emerging from the MENA region.

Conclusion

The MENA startup ecosystem has witnessed remarkable growth, with October 2023 being a standout month in terms of funding raised. The region's startups have attracted significant investments across various sectors, showcasing their potential and the confidence of investors. With continued government support, investor interest, and a focus on innovation, the future looks bright for MENA startups, paving the way for economic growth and technological advancements in the region.

Stars of Science Announces Registration Open for Season 16!

About Stars of Science

Over 15 years of success, Stars of Science, a leading innovation program and one of Qatar Foundation's educational entertainment reality TV initiatives, has solidified its position as one of the leading programs that empower innovators from different Arab countries to turn innovative ideas into tangible solutions, thus instilling a culture of innovation among young Arabs. Throughout its journey since 2009, the program has contributed to the development of technological solutions for their communities that benefit people's health and lifestyles, as well as in developing economic opportunities for members of their communities and promoting sustainable development.

Over twelve weeks, contestants develop and present their solutions through scientific experiments in a shared innovation space, taking into account the speed of implementation and benefiting from the guidance and support provided by a team of experienced engineers and product developers.

In each week, a panel of experts evaluates and selects promising innovators' projects and prototypes through testing rounds, with the ultimate goal of keeping three candidates to compete for the title and grand prize. The qualifiers are based on the deliberations of the jury and online public voting to determine the winners of the first and second places in each season.

If you are interested in entering the competition in the 16th season of Stars of Science and have the opportunity to win the title of best Arab innovator, you can register directly at the following link: https://www.starsofscience.info/ar

Please note that the deadline for registration for the new season is December1, 2023.

About Qatar Foundation – Unlocking Human Potential

Qatar Foundation for Education, Science and Community Development is a non-profit organization that supports Qatar in its journey towards building a diversified and sustainable economy. The Foundation seeks to meet the needs of the Qatari people and the world through the provision of specialized programs that are based on an innovative environment that combines education, research, science, and community development.

Qatar Foundation was founded in 1995 based on a wise vision shared by His Highness the Father Amir Sheikh Hamad bin Khalifa Al Thani and Her Highness Sheikha Moza bint Nasser that focuses on providing quality education to Qatar's children. Today, Qatar Foundation's high-quality educational system provides lifelong learning opportunities for members of the community, starting from the age of six months to the doctoral level, to enable them to compete in a global environment and contribute to the development of their country.

Qatar Foundation has also established a multidisciplinary innovation hub in Qatar, where local researchers work to address pressing national and global challenges. By promoting a culture of lifelong learning and stimulating community participation in programs that support Qatari culture, Qatar Foundation empowers the local community and contributes to building a better world.

To learn more about Qatar Foundation's initiatives and projects, please visit the website http://www.qf.org.qa

أعلن برنامج "نجوم العلوم" عن فتح باب التسجيل للاشتراك في موسمه الـ16 للمبتكرين العرب!

عن برنامج "نجوم العلوم"

على مدى 15 عاماً من النجاح، عزّز "نجوم العلوم" - وهو برنامج رائد في مجال الابتكار، وإحدى مبادرات مؤسسة قطر التي تندرج في إطار تلفزيون الواقع التعليمي الترفيهي – مكانته على رأس البرامج التي تروم تمكين المبتكرين من مختلف البلدان العربية من تحويل الأفكار المبتكرة إلى حلول ملموسة، بما يرسي ثقافة الابتكار بين أوساط الشباب العربي. فعلى مدى مساره التي انطلق منذ عام 2009، أسهم البرنامج في تطوير حلول تكنولوجية لمجتمعاتهم تعود بالنفع على صحة الناس وأساليب حياتهم، وكذلك في تطوير فرص اقتصادية لأفراد مجتمعاتهم وتعزيز التنمية المستدامة.

يقوم المتسابقون على مدار إثني عشر أسبوعاً بتطوير وعرض حلولهم عبر تجارب علمية، ضمن مساحة ابتكار مشتركة، مع الأخذ بعين الاعتبار السرعة في التنفيذ والاستفادة من الإرشاد والدعم الذي يقدمه فريق من المهندسين ذوي الخبرة ومطوري المنتجات.

في كل أسبوع، تقوم لجنة من الخبراء بتقييم وانتقاء مشاريع المبتكرين الواعدين ونماذجهم الأولية من خلال جولات الاختبار، ليتم في نهاية المطاف الإبقاء على ثلاثة مرشحين من أجل التنافس على اللقب والجائزة الكبرى. تعتمد التصفيات على مداولات لجنة التحكيم وتصويت الجمهور عبر الإنترنت لتحديد الفائزين بالمركز الأول والثاني في كل موسم.

إذا كنت من الراغبين بالدخول في المنافسة في الموسم السادس عشر من برنامج "نجوم العلوم" والحصول على فرصة الفوز بلقب أفضل مبتكر عربي، فيمكنك التسجيل مباشرة على الرابط الآتي: https://www.starsofscience.info/ar مع العلم أن الموعد النهائي للتسجيل في الموسم الجديد هو 1 كانون الأول/ديسمبر 2023.

نبذة عن مؤسسة قطر – إطلاق قدرات الإنسان:

مؤسسة قطر للتربية والعلوم وتنمية المجتمع هي منظمة غير ربحية تدعم دولة قطر في مسيرتها نحو بناء اقتصاد متنوع ومستدام. وتسعى المؤسسة لتلبية احتياجات الشعب القطري والعالم، من خلال توفير برامج متخصصة، ترتكز على بيئة ابتكارية تجمع ما بين التعليم، والبحوث والعلوم، والتنمية المجتمعية.

تأسست مؤسسة قطر في عام 1995 بناء على رؤية حكيمة تشاركها صاحب السمو الأمير الوالد الشيخ حمد بن خليفة آل ثاني وصاحبة السمو الشيخة موزا بنت ناصر تقوم على توفير تعليم نوعي لأبناء قطر. واليوم، يوفر نظام مؤسسة قطر التعليمي الراقي فرص التعلّم مدى الحياة لأفراد المجتمع، بدءاً من سن الستة أشهر وحتى الدكتوراه، لتمكينهم من المنافسة في بيئة عالمية، والمساهمة في تنمية وطنهم.

كما أنشأت مؤسسة قطر صرحًا متعدد التخصصات للابتكار في قطر، يعمل فيه الباحثون المحليون على مجابهة التحديات الوطنية والعالمية الملحة. وعبر نشر ثقافة التعلّم مدى الحياة، وتحفيز المشاركة المجتمعية في برامج تدعم الثقافة القطرية، تُمكّن مؤسسة قطر المجتمع المحلي، وتساهم في بناء عالم أفضل.

للاطلاع على مبادرات مؤسسة قطر ومشاريعها، يُرجى زيارة الموقع الإلكتروني http://www.qf.org.qa

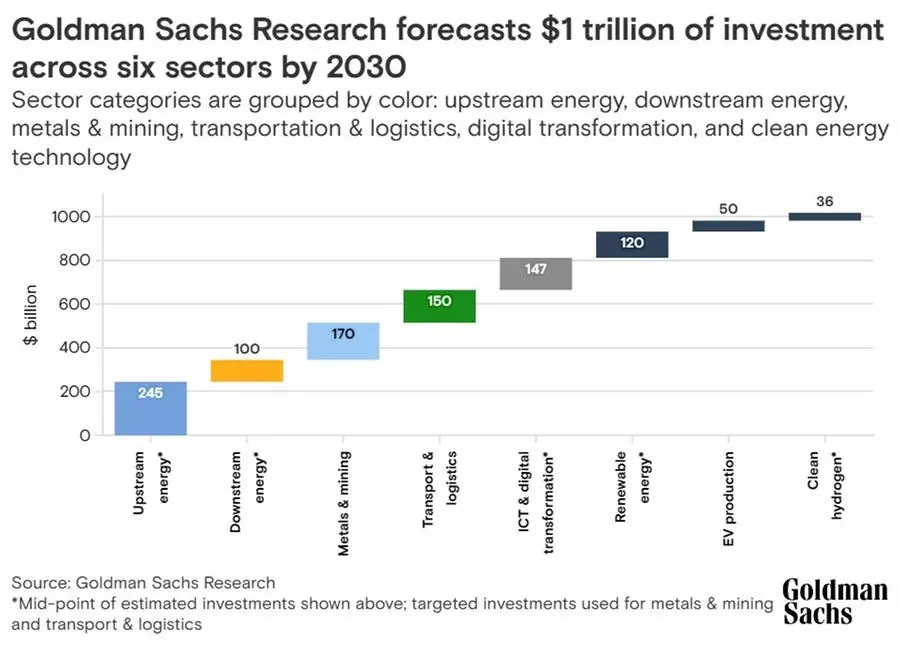

Around $1 trillion worth of preliminary investments will pour into Saudi Arabia’s six key sectors by 2030, as the kingdom implements a wave of reforms to transform its economy, according to Goldman Sachs Research.

Of the estimated investments, which are part of the $3.3 trillion targeted by the kingdom’s National Investment Strategy (NIS), $245 billion will be spent on upstream energy, while $100 billion and $170 billion will go to downstream energy, and metals and mining, analysts at the global investment banking said.

The transport and logistics sector will see around $150 billion, while total investments in ICT and digital transformation will reach $147 billion. Renewable energy, EV production and clean hydrogen will see investments reach around $120 billion, $50 billion and $36 billion, respectively, through the end of the decade.

The said sectors are already benefiting from increased investment, Goldman Sachs noted, adding that they are likely to drive a “capex supercycle” through the end of the decade.

“Within six strategic sectors, we see scope for nearly $1 trillion in preliminary investments through the end of the decade across investment programs, with more projects to be announced in tandem with technological progress and as Saudi accelerates execution of mega-projects and smart cities,” wrote Goldman Sachs Research analyst Faisal AlAzmeh in a team report.

In one of its latest briefings, Goldman Sachs noted that Saudi Arabia’s focus on diversifying its economy is already showing results.

The kingdom launched NIS in 2021 as a crucial enabler for achieving Vision 2030, the government’s blueprint for economic transformation. Its focus is to strengthen the role of foreign direct investment (FDI), which is expected to grow to 3.4% of GDP by 2025 and 5.7% by 2030.

A key pillar of the NIS is Shareek, a 2021 program that seeks to expand domestic investment made by private sector businesses to $1.3 trillion by 2030.

Some of the plans to boost investments

Among the sectors in focus, Saudi’s clean technology is set to see additional 60 gigawatts of renewable energy capacity and two to three GW of nuclear energy capacity by 2030.

In metals and mining, Saudi Arabia announced a new investment law in 2021 to facilitate the issuance of mining licenses and leverage an estimated $1.3 trillion worth of metals and minerals that are said to be “vastly unexplored”.

To boost its transportation and logistics sector, Saudi launched recently an updated National Transport and Logistics Strategy, a Saudi Aviation Strategy and a new national airline. There are also plans to expand the King Salman International Airport.

As for digital transformation, the country’s telecommunications providers are focused on network capacity expansion, particularly 5G and fiber-to-home services.

source: Zawya

Doha’s rise has also been primarily driven by the return of movement to pre-pandemic levels of freedom of international travel, attracting large volumes of migrant talent and tourism, with the FIFA World Cup Qatar 2022 welcoming over 1.4mln visitors.

Doha, Qatar: Qatar’s capital, Doha, has recorded a significant rise in Kearney’s 2023 Global Cities Index powered by Doha’s substantial improvements in the Human Capital dimension, moving up the global rankings by 13 places.

Doha’s rise has also been primarily driven by the return of movement to pre-pandemic levels of freedom of international travel, attracting large volumes of migrant talent and tourism, with the FIFA World Cup Qatar 2022 welcoming over 1.4 million visitors.

The city also saw a six-point jump in its Business Activity ranking, continuing to reap the benefits of open economic policies introduced in recent years, ushering it into the top 50.

The renowned index by Kearney, a leading global management consulting firm, highlights the beginning of a shake-up in the traditional hierarchy of global cities, with emerging hubs — including Doha — experiencing incredible gains, contributing to a new distributed geography of opportunity. Doha’s meteoric rise globally as a sports, tourism and events hub has seen it climb into the top 50 for the first time and rank second regionally.

The Global Cities Index (GCI) seeks to quantify the extent to which a city can attract, retain, and generate global flows of capital, people, and ideas. Cities are measured against five key dimensions: human capital, information exchange, cultural experience, political engagement, and business activity.

The latest milestone complements Qatar’s growing global stature. Recently, Qatar was ranked the most peaceful country in the Middle East and North Africa, according to the 17th edition of the Global Peace Index (GPI) 2023.

The ranking also placed Qatar 21st in the world, recording a jump of two spots this year.

“Qatar’s commitment to realising its Vision 2030 has led its capital city to begin closing in on more established global city leaders. An increased focus on improving the investment environment, building upon the country’s decades-long undertaking to develop a world-class educational system and relative ease of access to global talent, has helped Doha to prove its resilience amid challenging global conditions,” commented Rudolph Lohmeyer, Kearney Partner, National Transformation Institute.

In April, Doha also made the top 10 safest global tourist destinations in a UK security training outfit ‘Get Licensed’ survey.

While the GCI captures the current state of global city leadership; the Global Cities Outlook (GCO) aims to identify cities most likely to achieve global prominence. Here, the emergence of a distributed geography of opportunity was also present.

European cities maintained a strong presence in the top 30 rankings, while Asia’s global hubs, including Seoul, Osaka, and Chennai, made significant strides.

In the US, second-tier metropolitan areas performed particularly well, having successfully attracted talent and capital over the turbulent past few years.

Source: Zaway

Egypt-based healthtech Almouneer has raised a $3.6 million Seed round, led by Global Ventures, Proparco and Digital Africa through the Bridge Fund (FRA), Wrightwood Investments (UK) - and other international funds.

Founded in 2017 by Noha Khater and Rania Kadry, Almouneer is a digital transformation platform to serve patients with chronic diseases.

Proceeds to further develop DRU - Almouneer’s patient-centric platform - treating pre-diabetes, diabetes and obesity.

Press release:

Almouneer, the leading digital transformation platform revolutionising healthcare for patients and doctors across the Middle East and Africa (MEA), announces its seed round fundraise of US$3.6 million.

The seed round was led by Dubai-based Global Ventures, with participation from other renowned international investors: Proparco and Digital Africa, through the Bridge Fund, Wrightwood Investments - the family office of Diane & Henry Engelhardt (UK) - and other leading international funds.

The fundraise follows rapid growth for Almouneer as it serves over 120,000 patients, with business volumes having doubled in the last year and its leadership team boosted with several key hires.

The proceeds will primarily support the development and expansion of DRU - MEA's first patient-centric, digitally-enabled lifestyle and diabetes management platform. DRU aids in the prevention and management of diabetes, pre-diabetes, and obesity - and will serve millions in Egypt and MEA. The scalable platform uses cutting-edge patient and doctor-facing applications and an extensive provider network.

Proceeds will enhance DRU’s state-of-the-art technology further and grow its wider provider ecosystem (doctors / health coaches / labs / nutritionists). Almouneer will also build MEA’s first online, patient-customized treatment plans. DRU currently connects to Continuous Glucose Monitors and other glucometers and will soon enable connection to wearables such as smart watches.

2024 is set to be a year of important milestones. In Q1, Almouneer will launch its DRU app for doctors - connecting healthcare providers with millions of patients. The company’s strategy is to expand regionally and internationally - with market entries to Saudi Arabia, the U.A.E., and African countries including Nigeria and Kenya - anticipated by next year.

The MEA region has very high levels of obesity and prediabetes - affecting over 40% of its population - making Almouneer and DRU’s mission to empower patients and healthcare professionals more critical than ever. Egypt has 15 million diabetics alone (20% of adults) with KSA having 7 million (30% of adults). Adding those suffering from pre-diabetes and obesity makes the problem even more endemic yet is largely preventable by lifestyle management and monitoring.

Noha Khater, co-founder and CEO of Almouneer, said: “We are very excited to be announcing this round—an important achievement and milestone in our journey.

Over the past year, we managed to grow our team and successfully build DRU. This round will now catapult us into the next phase of our business, helping us grow our team and talent further, invest in our technology, and broaden DRU’s provider network—inching us even closer to our vision.

And as we do, we’d like to extend our deepest gratitude to our investors—Noor Sweid and Said Murad from Global Ventures, Henry Engelhardt of Wrightwood Investments, and Proparco—for their belief in us and in our mission. We also wouldn’t be here today had it not been for the unwavering support and championing of Cartier Women’s Initiative, INSEAD, Endeavor and our friends at Alliance Law Firm."

Noor Sweid, Founder and Managing Partner of Global Ventures, commented: “We are thrilled to welcome Almouneer to the Global Ventures portfolio and lead the company's seed round.

Over the years, we have had the privilege of working with a stellar group of healthcare entrepreneurs who are materially improving the lives of patients worldwide, enhancing access, quality and cost of care. Noha and Rania are now part of this group. We are excited to work alongside them as they leverage their specialized expertise across business-building and chronic care to tackle a prevalent health issue across the Middle East and Africa.

On its mission to become the lifelong companion of diabetic patients in the region, Almouneer is a unique and necessary innovation.”

Henry Engelhardt, of Wrightwood Investments, commented: "The work Almouneer does is truly valuable to the ever-growing diabetic community in Egypt and beyond.

Noha Khater and Rania Kadry, its two leaders, are truly exceptional, talented people, driven to make a positive difference to so many people’s lives. Wrightwood Investments [the family office of Diane & Henry Engelhardt] is proud to be an investor and part of the Almouneer family.”

Fabrice Perez, Head of VC Division at Proparco, said: “Almouneer is dedicated to fostering innovation and industry disruption through its array of digital services for patients and clinic networks. This objective strongly aligns with the goals of both Proparco and Digital Africa.”

Babacar Seck, CEO of Digital Africa, commented: “Digital Africa welcomes Almouneer to the Bridge Fund portfolio with great enthusiasm, as we are investing in a strategic, high-impact sector. We are delighted to contribute to Noha and her teams, and behind them all the patients for who Almouneer simplifies life.”

Source: Wamda

The private credit fund Ruya Private Capital I LP, run by Ruya Partners, has received a $10 million investment from Saudi Venture Capital (SVC).

Founded in 2020 by Omar Al Yawer, Mirza Beg and Rashid Siddiqi, Ruya Partners is an independent private credit firm that provides funding solutions to private sector companies in developing markets.

The fund will focus on providing capital solutions in the form of private debt instruments to SMEs, with a concentration on mid-market companies, including late-stage venture capital-backed businesses in Saudi Arabia and the region.

Press release:

Saudi Venture Capital (SVC) announced its investment of $10 million in "Ruya Private Capital I LP," a private credit fund managed by Ruya Partners.

The fund will focus on providing capital solutions in the form of private debt instruments to SMEs, with a concentration on mid-market companies, including late-stage venture capital-backed businesses, in Saudi Arabia and the region.

The subscription agreement was signed by Dr. Nabeel Koshak, CEO and Board Member at SVC, and Omar Al Yawer, Partner at Ruya Partners.

The signing ceremony was also attended by Nora Alsarhan, Chief Investment Officer, and Haifa Bahaian, Chief Legal Officer at SVC, as well as Mirza Beg and Rashid Siddiqi, Founding Partners at Ruya Partners.

Dr. Koshak commented: "The investment in the private credit fund managed by Ruya Partners is part of SVC's Investment in Funds Program. The investment also comes as a result of the increasing demand for venture debt and private debt by Saudi startups and SMEs and to implement SVC's strategy related to the launch of the "Investment in Venture Debt Funds and Private Debt Funds" product to fill financing gaps in the ecosystem".

"We are honored to have received this commitment of capital and trust from SVC and look forward to a successful partnership together," stated Omar Al Yawer.

The Founding Partners Mirza Beg and Rashid Siddiqi added: "We firmly believe that offering private credit capital solutions to companies in a manner which is non-dilutive to shareholders will serve as a powerful catalyst for their future growth and should contribute towards the continued expansion and development of the SME ecosystem."

SVC is a government investment company established in 2018 and is a subsidiary of the SME Bank, one of the developmental banks affiliated with the National Development Fund. SVC aims to stimulate and sustain financing for startups and SMEs from pre-Seed to pre-IPO by investing $2 billion through investment in funds and co-investment in startups. SVC invested in 43 funds that have invested in 700+ companies.

Source: Wamda

Talent Acceleration Platform (TAP), a promising startup in the tech industry, has recently announced the successful completion of a seed funding round. Led by Wamda Capital, the round raised an impressive $1 million, highlighting the confidence and support TAP has garnered from investors. This significant investment will undoubtedly propel TAP's growth and enable the company to further develop its innovative solutions.

The Seed Funding Round:

TAP's seed funding round, which closed recently, has been a resounding success. The round was led by Wamda Capital, a renowned venture capital firm known for its strategic investments in high-potential startups. The participation of other notable investors further validates TAP's potential and underscores the market's confidence in the company's vision.

TAP's Innovative Solutions:

TAP has been making waves in the tech industry with its groundbreaking solutions. The company focuses on developing cutting-edge technologies that revolutionize the way businesses operate. TAP's flagship product is a state-of-the-art software platform that streamlines and automates various business processes, enhancing efficiency and productivity.

The Importance of Seed Funding:

Seed funding plays a crucial role in the early stages of a startup's journey. It provides the necessary capital to fuel growth, develop products, and expand the team. TAP's successful seed funding round not only demonstrates the market's belief in the company's potential but also provides the resources needed to accelerate its growth trajectory.

Wamda Capital's Strategic Investment:

Wamda Capital's decision to lead TAP's seed funding round is a testament to the startup's promising future. With its extensive experience and network in the tech industry, Wamda Capital brings more than just financial support to the table. Their strategic guidance and industry expertise will undoubtedly prove invaluable as TAP continues to scale and establish itself as a key player in the market.

Future Prospects:

With the infusion of $1 million in seed funding, TAP is well-positioned to capitalize on the market opportunities and further develop its innovative solutions. The funding will enable the company to expand its team, enhance its product offerings, and accelerate its go-to-market strategy. TAP's future prospects look promising, and the company is poised to make a significant impact in the tech industry.

TAP's successful seed funding round, led by Wamda Capital, marks a significant milestone in the company's journey. The $1 million investment will provide the necessary resources for TAP to continue its growth trajectory and solidify its position as a leading player in the tech industry. With its innovative solutions and strategic partnerships, TAP is poised to make a lasting impact and shape the future of business operations.

About TAP:

TAP founded in 2018, is a Dutch/ Palestinian initiative that provides talented youth in Palestine with 16-week online educational programs to prepare them for remote work with European companies. TAP's programs focus on developing in-demand technical skills and power skills.

Once participants complete TAP's programs, they are connected with potential employers through TAP's network of European companies. TAP's new funding will enable it to expand to other countries in the MENA region in the coming years.

For more information, you can visit their website by clicking here.