News

News (66)

Saudi Arabia-based SaaS provider Salla has raised a $130 million pre-IPO investment round, led by Investcorp, along with Sanabil Investment and STV.

Founded in 2016 by Nawaf Hariri and Salman Butt, Salla enables merchants to set up their e-commerce online shops within hours.

The investment was made through Investcorp Saudi Pre-IPO Growth Fund LP, a platform targeting equity growth capital investments across a range of companies primarily based in Saudi Arabia.

Press release:

Investcorp, a leading global alternative investment firm, today announced it has led a $130 million pre-IPO investment round in Salla, a leading SaaS e-commerce enablement platform in Saudi Arabia. The investment was made alongside Sanabil Investment, a wholly owned company by Saudi Arabia’s Public Investment Fund. STV, a regional venture capital investor and an existing shareholder of Salla, also participated in the transaction.

Salla was established in 2016 in Makkah to promote the entrepreneurial ecosystem in Saudi Arabia by providing SMEs and aspiring entrepreneurs with a proprietary SaaS solution to deliver on their e-commerce ambitions. Today, Salla enables merchants to tap into a $20 billion e-commerce market expected to grow over 25% year-on-year in the coming years. Since 2020, Salla has enabled $7 billion in e-commerce sales and currently serves over 80 thousand active merchants on the platform.

Founded by Nawaf Hariri and Salman Butt, the company now has over 160 developers focused on technology and product development. It offers merchants a fully-digitalized and automated solution, allowing them to build their e-commerce website, start selling their products online within a few hours, accept online payments, and ship their products to the end user. Beyond being fully integrated with online payment solutions and logistics companies, Salla has over 400 applications on its platform, supporting its merchants throughout the lifecycle of running an online business.

Investcorp’s investment was made through Investcorp Saudi Pre-IPO Growth Fund LP, a platform targeting equity growth capital investments across a range of companies primarily based in Saudi Arabia with the potential to access the capital markets. Additionally, Robin Mansour, Principal at Investcorp, will be joining the Board of Directors of Salla.

The Fund allows investors to gain exposure to growing and market-leading businesses in strategic, high-growth sectors such as business services, transport and logistics, healthcare, and consumer.Investcorp Head of Emerging Markets Private Equity, Walid Majdalani, said, “Saudi Arabia today has over a million SMEs, having grown three times over the past five years. We believe that the Kingdom’s transformation agenda will continue to drive innovation and empower the next generation of entrepreneurs, with Salla acting as a key enabler to support the development of new companies in the e-commerce ecosystem”.

He added, “We see great interest in the potential of Saudi companies to IPO, especially as scale-ups and unicorns demonstrate local and regional success. Salla has managed to grow exponentially and deliver best-in-class margins.

We are excited to be part of their next growth phase and are keen to work with the founder and management team to explore a potential future listing in line with our track record”.

Nawaf Hariri, CEO and co-founder of Salla, added, “We are deeply grateful for the trust and investment from Investcorp and Sanabil in Salla, which reflects their confidence in our vision and our platform’s potential.

This investment propels us forward in our ongoing mission to open opportunities and empower individuals, SMEs, and enterprises to start and expand their businesses both within and beyond Saudi Arabia. We are committed to delivering innovative, customer-centric solutions that simplify and enhance the e-commerce experience for our merchants.”

Investcorp, through Investcorp Saudi Pre-IPO Growth Fund LP, previously led a pre-IPO funding round in TruKKer, a leading MENA digital freight network, with over 45,000 trucks inducted on its platform. This was followed by the fund’s investment in NourNet, one of Saudi Arabia’s leading ICT companies, with over 1,200 B2B clients operating across 20 industries.

Source: Wamda

Riyadh, Saudi Arabia: Anabolic Food Technologies, a Saudi-based food tech company, has announced the closing of a $9 million seed round at a valuation of $33 million. The investment will be used to accelerate the company's technology development and expand its reach in the Saudi market.

Technology:

Anabolic's app uses machine learning to analyze a user's unique dietary needs and preferences, creating customized meal plans that fit their lifestyle. Whether you're a busy professional, a fitness enthusiast, or a student on the go, the app has something for everyone.

About Anabolic:

Founded in 2023, Anabolic is a food tech company specializing in personalized meal plans and supply chain solutions. The company's platform leverages the expertise of chefs, nutritionists, and software engineers to combine culinary artistry with the precision of food algorithms.

The Saudi Food Tech Industry:

The Saudi food tech industry is a rapidly growing sector, attracting significant investment and fostering a wave of innovative startups. Driven by factors like rising demand for convenience and healthy food options, government support for the tech sector, and increasing smartphone penetration, the industry is expected to continue its upward trajectory, offering exciting opportunities for both startups and investors.

Saudi Arabia, Swiss Fund to launch billion-euro zero-emissions investment initiative

06 Feb 2024 Written by Admin AdminIn a move towards bolstering investments in zero-emissions projects, Saudi Minister of Investment Eng. Khalid Al-Falih announced a collaboration with a Swiss fund aimed at launching financing initiatives in the debt market. This partnership is set to mobilize billions of euros, showcasing Saudi Arabia's commitment to becoming a leading destination for sustainable investment. Al-Falih made this announcement during a Saudi-Swiss round table meeting in Riyadh, where he emphasized the Kingdom's ambition to position itself as a global hub for logistics, finance, and industry.

The meeting, attended by notable figures including Swiss Federal Councillor Guy Bernard Parmelin and Saudi Minister of Industry and Mineral Resources Eng. Bandar Alkhorayef, also focused on other areas of cooperation. Besides the investment in zero-emissions areas, the collaboration extends to the insurance industry, which is expected to see significant growth in the coming years.

Highlighting the vast potential for infrastructure development, Al-Falih pointed to Saudi Arabia's plans for mega projects, with more than $3.3 trillion earmarked for various sectors including airports, factories, and green energy networks. A substantial portion of this investment, approximately $1.8 trillion, is anticipated to be financed through bids to attract global investors from Switzerland and beyond, ensuring the highest quality standards for these projects.

Al-Falih also underlined the strong economic partnership and deep-rooted bilateral relations between Saudi Arabia and Switzerland, which are poised to celebrate a century of cooperation by 2027. With the Kingdom's Vision 2030, Saudi Arabia is setting ambitious targets, aiming for an investment volume of $3.3 trillion by 2030.

Eng. Bandar Alkhorayef highlighted the opportunities for future cooperation with Swiss sectors, emphasizing the Kingdom's role as a critical economic bridge linking the Middle East and Africa region with neighboring countries. He outlined Saudi Arabia's strategy to diversify the economy across 12 industrial sectors, categorized into three main groups focusing on national security, maximizing natural resources, and pioneering future industries such as space and renewable energy.

Source: Saudi Gazette

Saudi Aramco, the world's largest oil company, has made a significant move by injecting an additional $4 billion into its venture capital arm, Aramco Ventures. This substantial investment reflects Aramco's commitment to diversifying its portfolio and embracing innovation in the rapidly evolving energy landscape. The expansion of Aramco Ventures not only signifies a strategic shift towards technology and sustainability but also holds the potential to reshape the startup ecosystem and contribute to economic growth.

Introduction to Aramco Ventures

Aramco Ventures, the venture capital arm of Saudi Aramco, was established to identify and invest in innovative technologies and business models that have the potential to disrupt the energy sector. With a focus on fostering entrepreneurship and driving technological advancements, Aramco Ventures plays a pivotal role in supporting startups and emerging companies.

Aramco's Additional $4 Billion Investment

The injection of an additional $4 billion into Aramco Ventures underscores the company's commitment to nurturing a culture of innovation and embracing transformative technologies. This substantial capital infusion is aimed at fueling the growth of startups and scaling up innovative solutions that align with Aramco's strategic objectives.

Expansion of Aramco Ventures

The significant increase in capital allocation to Aramco Ventures signifies a major expansion of the venture capital arm's investment scope. This expansion presents an opportunity for startups and entrepreneurs to access the necessary funding and resources to drive their ventures forward, ultimately contributing to the development of a vibrant and dynamic startup ecosystem.

Focus on Technology and Innovation

Aramco's heightened focus on technology and innovation through its venture capital arm reflects the company's recognition of the pivotal role that disruptive technologies play in shaping the future of the energy industry. By investing in cutting-edge technologies and innovative business models, Aramco Ventures aims to stay at the forefront of industry transformation and drive sustainable growth.

Aramco's Strategic Investments

The strategic investments made by Aramco Ventures are carefully curated to align with the company's long-term vision and goals. By strategically allocating capital to startups and emerging companies that demonstrate potential for innovation and impact, Aramco Ventures seeks to foster a culture of collaboration and drive positive change within the energy sector.

Impact on the Startup Ecosystem

The substantial injection of funds into Aramco Ventures is poised to have a profound impact on the startup ecosystem, particularly within the energy and technology domains. This influx of capital not only provides startups with the financial backing they need but also opens doors to mentorship, industry expertise, and strategic partnerships, thereby propelling the growth and success of innovative ventures.

Aramco's Contribution to Economic Growth

Aramco's continued investment in technology and innovation through Aramco Ventures is expected to have far-reaching implications for economic growth. By empowering startups and fostering a culture of entrepreneurship, Aramco contributes to job creation, knowledge transfer, and the development of a robust innovation ecosystem, ultimately driving economic prosperity.

Collaboration and Partnerships

Aramco Ventures' expanded investment portfolio creates opportunities for collaboration and partnerships between startups, established companies, and industry experts. This collaborative approach not only fosters knowledge exchange and innovation but also accelerates the development and adoption of transformative technologies that can address complex energy challenges.

Aramco's Vision for the Future

The substantial investment in Aramco Ventures reflects the company's forward-looking vision and commitment to shaping the future of energy. By actively engaging with startups and innovative ventures, Aramco aims to drive sustainable solutions, enhance operational efficiency, and contribute to the global energy transition, aligning with its vision for a more sustainable and resilient energy landscape.

Sustainability and Environmental Initiatives

Aramco's increased focus on sustainability and environmental initiatives is mirrored in its investment strategy through Aramco Ventures. By supporting startups and technologies that prioritize environmental stewardship and sustainable practices, Aramco reinforces its dedication to mitigating environmental impact and advancing the transition towards a low-carbon future.

Aramco's Role in Energy Transition

The expansion of Aramco Ventures underscores the company's proactive role in driving the energy transition. By investing in innovative solutions that promote energy efficiency, renewable energy integration, and carbon reduction, Aramco contributes to the global efforts aimed at addressing climate change and advancing the transition to a more sustainable and diversified energy mix.

Challenges and Opportunities

While the expansion of Aramco Ventures presents significant opportunities for startups and the energy industry, it also brings forth a set of challenges. Navigating the complexities of technological innovation, market dynamics, and regulatory landscapes requires a strategic approach and a deep understanding of the evolving energy ecosystem.

Aramco's injection of an additional $4 billion into Aramco Ventures marks a pivotal moment in the company's journey towards embracing innovation, technology, and sustainability. This substantial investment not only amplifies the support available to startups and emerging companies but also underscores Aramco's commitment to driving positive change within the energy sector. As Aramco Ventures continues to expand its investment portfolio and foster collaboration, its impact on the startup ecosystem and the broader energy industry is poised to be transformative, shaping the future of energy innovation and sustainability.

From Electronics to Cars: Soum Takes Re-commerce Beyond Borders with $18 Million

03 Jan 2024 Written by Admin AdminSaudi Arabia-based re-commerce marketplace Soum has successfully raised $18 million in a Series A funding round, with Jahez leading the investment and participation from Isometry Capital, Khwarizmi Ventures, Alrajhi Partners, and Outliers Venture Capital. Founded in 2021 by Fahad Al Hassan, Fahad Albassam, and Bader Almubarak, Soum serves as a platform for SMEs and individuals to sell their secondhand products.

The latest funding will enable Soum to expedite its regional expansion plans and diversify beyond its core vertical of secondhand electronics. The company aims to broaden its offerings to include products ranging from collectibles to automobiles, tapping into a combined market worth $40 billion.

Since its inception, Soum has experienced remarkable growth, with sales increasing by 40 times and maintaining exceptional unit economics and customer satisfaction scores. The platform has facilitated transactions to and from over 150 Saudi cities, establishing a unified national marketplace for buying, selling, and discovering products with trust and convenience. The Soum app, launched less than two years ago, has garnered over 4 million downloads in the Kingdom of Saudi Arabia and is gaining traction in the United Arab Emirates.

Fahad Alhassan, Co-Founder & CEO of Soum, expressed the company's vision to be the go-to marketplace for buying and selling anything online with convenience and trust. The successful funding round reflects the dedication of the entire team and signifies the commencement of the next phase of growth, aligning with the mission to revolutionize online buying and selling.

Soum acts as a trusted intermediary for each transaction, alleviating the challenges faced by buyers and sellers in the MENA region when navigating spam-infested classified platforms. This approach ensures a seamless and secure transaction experience for all parties involved.

Abdulaziz Alhouti, Chief Investment Officer of Jahez, commended the remarkable achievements of the Soum team, emphasizing their dedication to innovation and customer satisfaction. The investment reflects confidence in Soum's potential to redefine the e-commerce landscape in the Middle East.

With the Series A funding as a catalyst, Soum is poised for continued growth, aiming to set new standards in innovation, customer satisfaction, and market impact in the Middle East. The Soum mobile app is available on the Apple App Store and Google Play Store, offering a seamless platform for buying and selling secondhand products with convenience and trust.

Source: News

Tameed Secures $15 Million to Fuel SME Lending Platform in Saudi Arabia

03 Jan 2024 Written by Admin AdminSaudi Arabia-based fintech company Tameed has successfully secured a substantial $15 million in a Series A funding round, with Alromaih Investments leading the investment. Established in 2019 by Mohammed Al Alshaikh and Mohammed Alomayyer, Tameed specializes in providing SMEs with P2P Shariah-compliant financing options for their government contract purchases through its digital platform.

The infusion of new capital will enable Tameed to expedite its expansion and cater to the growing demand for its digital lending products. The company, which obtained its operating license from the Saudi Central Bank (SAMA) in January 2023, has been operating within SAMA’s FinTech SandBox. Tameed has facilitated SME funding exceeding SAR 400 million, serving investors and borrowers through a mobile app with 50,000 downloads, and achieving a growth rate exceeding 400%.

Tameed's commitment to providing transparent pricing and swift loan processing, completed within three business days through a fully digitalized process, has earned the trust of its clients. The company's focus on efficiency in processing and customization of services translates into tailored products aimed at supporting SMEs in fulfilling their purchase order commitments.

Mr. Mohammed Alomayyer, the CEO and co-founder of Tameed, expressed optimism about the Kingdom’s economic growth and emphasized Tameed's dedication to meeting the needs of SMEs by offering innovative funding products. He highlighted the addition of performance bond financing for projects to serve a wider range of SMEs and support their effective participation in major projects.

Mr. Omar Alromaih, the CEO of Investments at Alromaih Group, underscored the belief in the opportunity and the sector, expressing anticipation for Tameed's continued growth and expansion of investment and funding opportunities to address the financing needs of SMEs and bridge the funding gaps created by Vision 2030 programs and projects.

Furthermore, Alromaih Group's strategy focuses on diversifying investment tools and risk mitigation through acquisitions, transactions, and investment rounds into the FinTech Division, recognized as one of the most promising and targeted sectors in the Kingdom’s Vision 2030.

Mr. Mohammed Al Alshaikh, the co-founder of Tameed, emphasized that the funding round will facilitate the company's growth to serve investors and SMEs requiring funding while innovating on the best technologies and products. He highlighted the recent launch of an Auto-Invest product designed to enable busy investors to engage in short-term funding opportunities based on pre-configured investment preferences.

Source: News

71% of consumers in Saudi Arabia confident about the future, surpassing global average: study

24 Nov 2023 Written by Admin AdminThe comprehensive study, spanning 19 markets worldwide, delves into the preferences and behaviors of consumers in the KSA, providing valuable insights into their outlook compared to their global counterparts

JEDDAH — In a positive spot in the world, Saudi Arabia radiates an optimistic glow, as a remarkable 71% of its population expresses confidence in the future. Surpassing the global average of 43%, this buoyant consumer sentiment unfolds in the latest Toluna Global Consumer Barometer.

The comprehensive study, spanning 19 markets worldwide, delves into the preferences and behaviors of consumers in the KSA, providing valuable insights into their outlook compared to their global counterparts.

The research indicates that a substantial 64% of KSA residents report heightened satisfaction with their current life and a greater sense of optimism about their future, surpassing the global average of 45%.

However, a noteworthy 25% of residents express concerns over personal financial security, attributing them to prevailing global and economic circumstances.

In response to economic uncertainties, KSA residents are taking proactive steps in financial planning. Notably, 29% plan to reduce spending on books and magazines, recognizing the abundance of online resources.

Similarly, 28% intend to cut back on luxury product or service expenses, while 24% will trim their entertainment and subscription budgets.

Additionally, 22% are opting to dine out less, 22% will curtail leisure activities and hobbies, 19% plan to spend less on vacation holidays, and 20% will refrain from buying new cars.

Looking ahead, the study sheds light on anticipated grocery shopping behavior in the next three months. Key drivers for KSA consumers include price, health, product availability, and quality.

Moreover, 45% of shoppers plan to reduce unnecessary purchases, and 39% will compare prices online and offline.

Other strategies include shopping more often to avoid waste and secure the best deals (31%), visiting more stores in search of value (28%), shopping less often but in bulk (30%), switching to cheaper brands (26%), and adjusting the number of snacks purchased (28%).

Georges Akkaoui, enterprise account director & office leader MEA at Toluna, commented on the findings, stating, "These findings reflect the current economic sentiment and consumer behavior in the KSA.

“Amidst positive signals, consumers are seeking value and reliability in their choices. Brands prioritizing quality, affordability, and sustainability will resonate most with today's savvy shoppers."

The study also outlines anticipated spending behavior in the coming quarter, with 26% planning to allocate more towards groceries, 19% towards mobile phones, 26% towards vitamins and minerals, 23% towards food takeaway, 19% towards sports and fitness, 18% towards life insurance, private health insurance (19%), and gaming (15%).

Source: Zawya

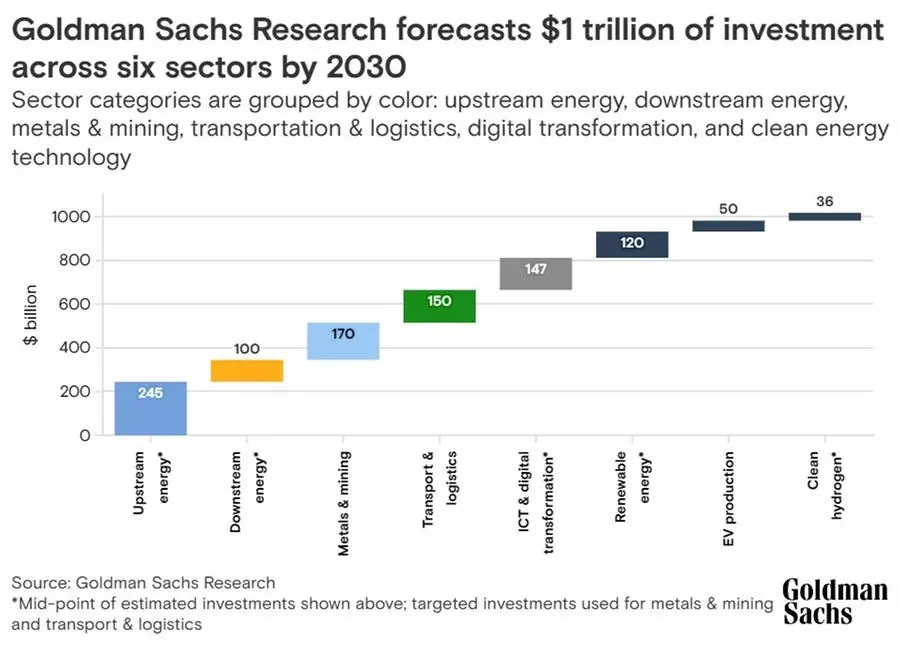

Investments in Saudi’s key sectors to hit $1trln by 2030 – Goldman Sachs

01 Nov 2023 Written by Admin AdminAround $1 trillion worth of preliminary investments will pour into Saudi Arabia’s six key sectors by 2030, as the kingdom implements a wave of reforms to transform its economy, according to Goldman Sachs Research.

Of the estimated investments, which are part of the $3.3 trillion targeted by the kingdom’s National Investment Strategy (NIS), $245 billion will be spent on upstream energy, while $100 billion and $170 billion will go to downstream energy, and metals and mining, analysts at the global investment banking said.

The transport and logistics sector will see around $150 billion, while total investments in ICT and digital transformation will reach $147 billion. Renewable energy, EV production and clean hydrogen will see investments reach around $120 billion, $50 billion and $36 billion, respectively, through the end of the decade.

The said sectors are already benefiting from increased investment, Goldman Sachs noted, adding that they are likely to drive a “capex supercycle” through the end of the decade.

“Within six strategic sectors, we see scope for nearly $1 trillion in preliminary investments through the end of the decade across investment programs, with more projects to be announced in tandem with technological progress and as Saudi accelerates execution of mega-projects and smart cities,” wrote Goldman Sachs Research analyst Faisal AlAzmeh in a team report.

In one of its latest briefings, Goldman Sachs noted that Saudi Arabia’s focus on diversifying its economy is already showing results.

The kingdom launched NIS in 2021 as a crucial enabler for achieving Vision 2030, the government’s blueprint for economic transformation. Its focus is to strengthen the role of foreign direct investment (FDI), which is expected to grow to 3.4% of GDP by 2025 and 5.7% by 2030.

A key pillar of the NIS is Shareek, a 2021 program that seeks to expand domestic investment made by private sector businesses to $1.3 trillion by 2030.

Some of the plans to boost investments

Among the sectors in focus, Saudi’s clean technology is set to see additional 60 gigawatts of renewable energy capacity and two to three GW of nuclear energy capacity by 2030.

In metals and mining, Saudi Arabia announced a new investment law in 2021 to facilitate the issuance of mining licenses and leverage an estimated $1.3 trillion worth of metals and minerals that are said to be “vastly unexplored”.

To boost its transportation and logistics sector, Saudi launched recently an updated National Transport and Logistics Strategy, a Saudi Aviation Strategy and a new national airline. There are also plans to expand the King Salman International Airport.

As for digital transformation, the country’s telecommunications providers are focused on network capacity expansion, particularly 5G and fiber-to-home services.

source: Zawya

SVC invests $10 million in Ruya Private Capital I to back Saudi SMEs

01 Nov 2023 Written by Admin AdminThe private credit fund Ruya Private Capital I LP, run by Ruya Partners, has received a $10 million investment from Saudi Venture Capital (SVC).

Founded in 2020 by Omar Al Yawer, Mirza Beg and Rashid Siddiqi, Ruya Partners is an independent private credit firm that provides funding solutions to private sector companies in developing markets.

The fund will focus on providing capital solutions in the form of private debt instruments to SMEs, with a concentration on mid-market companies, including late-stage venture capital-backed businesses in Saudi Arabia and the region.

Press release:

Saudi Venture Capital (SVC) announced its investment of $10 million in "Ruya Private Capital I LP," a private credit fund managed by Ruya Partners.

The fund will focus on providing capital solutions in the form of private debt instruments to SMEs, with a concentration on mid-market companies, including late-stage venture capital-backed businesses, in Saudi Arabia and the region.

The subscription agreement was signed by Dr. Nabeel Koshak, CEO and Board Member at SVC, and Omar Al Yawer, Partner at Ruya Partners.

The signing ceremony was also attended by Nora Alsarhan, Chief Investment Officer, and Haifa Bahaian, Chief Legal Officer at SVC, as well as Mirza Beg and Rashid Siddiqi, Founding Partners at Ruya Partners.

Dr. Koshak commented: "The investment in the private credit fund managed by Ruya Partners is part of SVC's Investment in Funds Program. The investment also comes as a result of the increasing demand for venture debt and private debt by Saudi startups and SMEs and to implement SVC's strategy related to the launch of the "Investment in Venture Debt Funds and Private Debt Funds" product to fill financing gaps in the ecosystem".

"We are honored to have received this commitment of capital and trust from SVC and look forward to a successful partnership together," stated Omar Al Yawer.

The Founding Partners Mirza Beg and Rashid Siddiqi added: "We firmly believe that offering private credit capital solutions to companies in a manner which is non-dilutive to shareholders will serve as a powerful catalyst for their future growth and should contribute towards the continued expansion and development of the SME ecosystem."

SVC is a government investment company established in 2018 and is a subsidiary of the SME Bank, one of the developmental banks affiliated with the National Development Fund. SVC aims to stimulate and sustain financing for startups and SMEs from pre-Seed to pre-IPO by investing $2 billion through investment in funds and co-investment in startups. SVC invested in 43 funds that have invested in 700+ companies.

Source: Wamda

Saudi Arabia and Switzerland partner to boost cleantech innovation and sustainability

29 Oct 2023 Written by Admin AdminSaudi Arabia and Switzerland hosted the first-ever Saudi-Swiss CleanTech Forum in 2023. The event brought together Swiss companies and small and medium-sized enterprises (SMEs) to showcase innovative solutions to address global challenges, combat climate change, and promote sustainability.

The forum was a partnership between the Embassy of Switzerland in Saudi Arabia, the Research, Development and Innovation Authority (RDIA), and King Abdulaziz City of Science and Technology (KACST). It aimed to boost international trade and economic ties between the two nations.

Discussions at the forum also revolved around the benefits of Saudi Arabia's Vision 2030, which strives to make the country a major industrial power and a global logistics hub.

In his keynote speech, Saudi Arabia's Minister of Economy and Planning, Faisal bin Fadel Al-Ibrahim, highlighted the importance of the partnership between Saudi Arabia and Switzerland, as well as the challenges facing the environment. He also stated that Saudi Arabia is a leading country in the Middle East for private sector investment, with around $5.5 billion invested in 2022.

Al-Ibrahim mentioned several significant projects, including the NEOM green hydrogen projects and a carbon capture facility. The NEOM green hydrogen projects, which are expected to be commissioned in 2026, will be the world's largest green energy facility and will be powered entirely by renewable energy.

Switzerland is known for its innovation and utilizes a "bottom-up" approach, with the government focusing on education and fundamental research to support companies. In an interview with Arab News, Helene Budliger Artieda, Swiss State Secretary for Economic Affairs, explained that the government's primary role is centered on funding a robust education system and supporting fundamental research at universities.

Artieda added that transitioning to a greener world is a key priority for both Saudi Arabia and Switzerland. She highlighted Switzerland's expertise in areas such as railways and water treatment and management. She also mentioned that there are various investment opportunities that Switzerland might be interested in, such as the Kingdom's vast areas, abundant solar parks, and green hydrogen initiatives.

Artieda emphasized the presence of numerous niche opportunities in the Kingdom, including investments in sustainable Saudi fashion. She noted that Switzerland has a well-established textile industry. She also expressed interest in the significant developments occurring in the global fashion industry, implying that Saudi Arabia is eager to align with global trends and standards, particularly those related to sustainability.

On Sunday, Artieda held a meeting with the minister of economy and planning to discuss ways to expand economic relationships, explore the potential for trade and investment collaboration between their respective countries, and review topics of mutual interest. She emphasized the significance of establishing a robust framework to facilitate this cooperation.

Additionally, the Saudi Press Agency reported on Sunday that Saudi Arabia's National Industrial Development and Logistics Program (NIDLP) organized a Saudi-Swiss symposium in Riyadh. The event had several objectives, including shedding light on the Kingdom's economic transformation and exploring investment opportunities between Saudi Arabia and Switzerland.

Saudi Arabia's non-oil exports to Switzerland are valued at around SR3.5 billion ($0.93 billion), while total imports from Switzerland into the Kingdom stand at approximately SR8 billion.

Overall, the Saudi-Swiss CleanTech Forum was a successful event that highlighted the importance of innovation and sustainability in addressing global challenges. The partnership between Saudi Arabia and Switzerland is a positive step towards achieving these goals.