Admin Admin

Stars of Science Announces Registration Open for Season 16!

About Stars of Science

Over 15 years of success, Stars of Science, a leading innovation program and one of Qatar Foundation's educational entertainment reality TV initiatives, has solidified its position as one of the leading programs that empower innovators from different Arab countries to turn innovative ideas into tangible solutions, thus instilling a culture of innovation among young Arabs. Throughout its journey since 2009, the program has contributed to the development of technological solutions for their communities that benefit people's health and lifestyles, as well as in developing economic opportunities for members of their communities and promoting sustainable development.

Over twelve weeks, contestants develop and present their solutions through scientific experiments in a shared innovation space, taking into account the speed of implementation and benefiting from the guidance and support provided by a team of experienced engineers and product developers.

In each week, a panel of experts evaluates and selects promising innovators' projects and prototypes through testing rounds, with the ultimate goal of keeping three candidates to compete for the title and grand prize. The qualifiers are based on the deliberations of the jury and online public voting to determine the winners of the first and second places in each season.

If you are interested in entering the competition in the 16th season of Stars of Science and have the opportunity to win the title of best Arab innovator, you can register directly at the following link: https://www.starsofscience.info/ar

Please note that the deadline for registration for the new season is December1, 2023.

About Qatar Foundation – Unlocking Human Potential

Qatar Foundation for Education, Science and Community Development is a non-profit organization that supports Qatar in its journey towards building a diversified and sustainable economy. The Foundation seeks to meet the needs of the Qatari people and the world through the provision of specialized programs that are based on an innovative environment that combines education, research, science, and community development.

Qatar Foundation was founded in 1995 based on a wise vision shared by His Highness the Father Amir Sheikh Hamad bin Khalifa Al Thani and Her Highness Sheikha Moza bint Nasser that focuses on providing quality education to Qatar's children. Today, Qatar Foundation's high-quality educational system provides lifelong learning opportunities for members of the community, starting from the age of six months to the doctoral level, to enable them to compete in a global environment and contribute to the development of their country.

Qatar Foundation has also established a multidisciplinary innovation hub in Qatar, where local researchers work to address pressing national and global challenges. By promoting a culture of lifelong learning and stimulating community participation in programs that support Qatari culture, Qatar Foundation empowers the local community and contributes to building a better world.

To learn more about Qatar Foundation's initiatives and projects, please visit the website http://www.qf.org.qa

أعلن برنامج "نجوم العلوم" عن فتح باب التسجيل للاشتراك في موسمه الـ16 للمبتكرين العرب!

عن برنامج "نجوم العلوم"

على مدى 15 عاماً من النجاح، عزّز "نجوم العلوم" - وهو برنامج رائد في مجال الابتكار، وإحدى مبادرات مؤسسة قطر التي تندرج في إطار تلفزيون الواقع التعليمي الترفيهي – مكانته على رأس البرامج التي تروم تمكين المبتكرين من مختلف البلدان العربية من تحويل الأفكار المبتكرة إلى حلول ملموسة، بما يرسي ثقافة الابتكار بين أوساط الشباب العربي. فعلى مدى مساره التي انطلق منذ عام 2009، أسهم البرنامج في تطوير حلول تكنولوجية لمجتمعاتهم تعود بالنفع على صحة الناس وأساليب حياتهم، وكذلك في تطوير فرص اقتصادية لأفراد مجتمعاتهم وتعزيز التنمية المستدامة.

يقوم المتسابقون على مدار إثني عشر أسبوعاً بتطوير وعرض حلولهم عبر تجارب علمية، ضمن مساحة ابتكار مشتركة، مع الأخذ بعين الاعتبار السرعة في التنفيذ والاستفادة من الإرشاد والدعم الذي يقدمه فريق من المهندسين ذوي الخبرة ومطوري المنتجات.

في كل أسبوع، تقوم لجنة من الخبراء بتقييم وانتقاء مشاريع المبتكرين الواعدين ونماذجهم الأولية من خلال جولات الاختبار، ليتم في نهاية المطاف الإبقاء على ثلاثة مرشحين من أجل التنافس على اللقب والجائزة الكبرى. تعتمد التصفيات على مداولات لجنة التحكيم وتصويت الجمهور عبر الإنترنت لتحديد الفائزين بالمركز الأول والثاني في كل موسم.

إذا كنت من الراغبين بالدخول في المنافسة في الموسم السادس عشر من برنامج "نجوم العلوم" والحصول على فرصة الفوز بلقب أفضل مبتكر عربي، فيمكنك التسجيل مباشرة على الرابط الآتي: https://www.starsofscience.info/ar مع العلم أن الموعد النهائي للتسجيل في الموسم الجديد هو 1 كانون الأول/ديسمبر 2023.

نبذة عن مؤسسة قطر – إطلاق قدرات الإنسان:

مؤسسة قطر للتربية والعلوم وتنمية المجتمع هي منظمة غير ربحية تدعم دولة قطر في مسيرتها نحو بناء اقتصاد متنوع ومستدام. وتسعى المؤسسة لتلبية احتياجات الشعب القطري والعالم، من خلال توفير برامج متخصصة، ترتكز على بيئة ابتكارية تجمع ما بين التعليم، والبحوث والعلوم، والتنمية المجتمعية.

تأسست مؤسسة قطر في عام 1995 بناء على رؤية حكيمة تشاركها صاحب السمو الأمير الوالد الشيخ حمد بن خليفة آل ثاني وصاحبة السمو الشيخة موزا بنت ناصر تقوم على توفير تعليم نوعي لأبناء قطر. واليوم، يوفر نظام مؤسسة قطر التعليمي الراقي فرص التعلّم مدى الحياة لأفراد المجتمع، بدءاً من سن الستة أشهر وحتى الدكتوراه، لتمكينهم من المنافسة في بيئة عالمية، والمساهمة في تنمية وطنهم.

كما أنشأت مؤسسة قطر صرحًا متعدد التخصصات للابتكار في قطر، يعمل فيه الباحثون المحليون على مجابهة التحديات الوطنية والعالمية الملحة. وعبر نشر ثقافة التعلّم مدى الحياة، وتحفيز المشاركة المجتمعية في برامج تدعم الثقافة القطرية، تُمكّن مؤسسة قطر المجتمع المحلي، وتساهم في بناء عالم أفضل.

للاطلاع على مبادرات مؤسسة قطر ومشاريعها، يُرجى زيارة الموقع الإلكتروني http://www.qf.org.qa

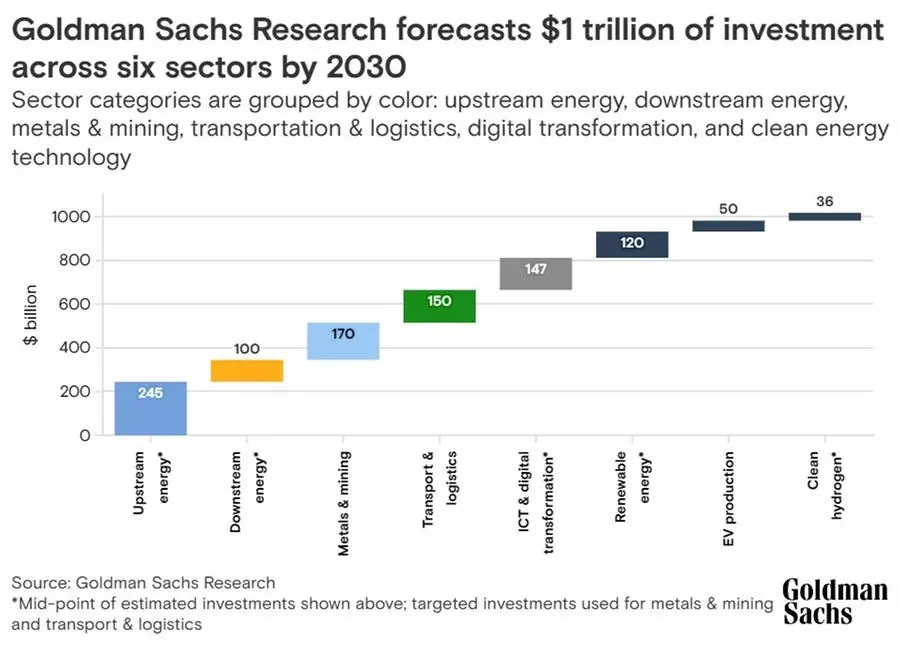

Around $1 trillion worth of preliminary investments will pour into Saudi Arabia’s six key sectors by 2030, as the kingdom implements a wave of reforms to transform its economy, according to Goldman Sachs Research.

Of the estimated investments, which are part of the $3.3 trillion targeted by the kingdom’s National Investment Strategy (NIS), $245 billion will be spent on upstream energy, while $100 billion and $170 billion will go to downstream energy, and metals and mining, analysts at the global investment banking said.

The transport and logistics sector will see around $150 billion, while total investments in ICT and digital transformation will reach $147 billion. Renewable energy, EV production and clean hydrogen will see investments reach around $120 billion, $50 billion and $36 billion, respectively, through the end of the decade.

The said sectors are already benefiting from increased investment, Goldman Sachs noted, adding that they are likely to drive a “capex supercycle” through the end of the decade.

“Within six strategic sectors, we see scope for nearly $1 trillion in preliminary investments through the end of the decade across investment programs, with more projects to be announced in tandem with technological progress and as Saudi accelerates execution of mega-projects and smart cities,” wrote Goldman Sachs Research analyst Faisal AlAzmeh in a team report.

In one of its latest briefings, Goldman Sachs noted that Saudi Arabia’s focus on diversifying its economy is already showing results.

The kingdom launched NIS in 2021 as a crucial enabler for achieving Vision 2030, the government’s blueprint for economic transformation. Its focus is to strengthen the role of foreign direct investment (FDI), which is expected to grow to 3.4% of GDP by 2025 and 5.7% by 2030.

A key pillar of the NIS is Shareek, a 2021 program that seeks to expand domestic investment made by private sector businesses to $1.3 trillion by 2030.

Some of the plans to boost investments

Among the sectors in focus, Saudi’s clean technology is set to see additional 60 gigawatts of renewable energy capacity and two to three GW of nuclear energy capacity by 2030.

In metals and mining, Saudi Arabia announced a new investment law in 2021 to facilitate the issuance of mining licenses and leverage an estimated $1.3 trillion worth of metals and minerals that are said to be “vastly unexplored”.

To boost its transportation and logistics sector, Saudi launched recently an updated National Transport and Logistics Strategy, a Saudi Aviation Strategy and a new national airline. There are also plans to expand the King Salman International Airport.

As for digital transformation, the country’s telecommunications providers are focused on network capacity expansion, particularly 5G and fiber-to-home services.

source: Zawya

Doha’s rise has also been primarily driven by the return of movement to pre-pandemic levels of freedom of international travel, attracting large volumes of migrant talent and tourism, with the FIFA World Cup Qatar 2022 welcoming over 1.4mln visitors.

Doha, Qatar: Qatar’s capital, Doha, has recorded a significant rise in Kearney’s 2023 Global Cities Index powered by Doha’s substantial improvements in the Human Capital dimension, moving up the global rankings by 13 places.

Doha’s rise has also been primarily driven by the return of movement to pre-pandemic levels of freedom of international travel, attracting large volumes of migrant talent and tourism, with the FIFA World Cup Qatar 2022 welcoming over 1.4 million visitors.

The city also saw a six-point jump in its Business Activity ranking, continuing to reap the benefits of open economic policies introduced in recent years, ushering it into the top 50.

The renowned index by Kearney, a leading global management consulting firm, highlights the beginning of a shake-up in the traditional hierarchy of global cities, with emerging hubs — including Doha — experiencing incredible gains, contributing to a new distributed geography of opportunity. Doha’s meteoric rise globally as a sports, tourism and events hub has seen it climb into the top 50 for the first time and rank second regionally.

The Global Cities Index (GCI) seeks to quantify the extent to which a city can attract, retain, and generate global flows of capital, people, and ideas. Cities are measured against five key dimensions: human capital, information exchange, cultural experience, political engagement, and business activity.

The latest milestone complements Qatar’s growing global stature. Recently, Qatar was ranked the most peaceful country in the Middle East and North Africa, according to the 17th edition of the Global Peace Index (GPI) 2023.

The ranking also placed Qatar 21st in the world, recording a jump of two spots this year.

“Qatar’s commitment to realising its Vision 2030 has led its capital city to begin closing in on more established global city leaders. An increased focus on improving the investment environment, building upon the country’s decades-long undertaking to develop a world-class educational system and relative ease of access to global talent, has helped Doha to prove its resilience amid challenging global conditions,” commented Rudolph Lohmeyer, Kearney Partner, National Transformation Institute.

In April, Doha also made the top 10 safest global tourist destinations in a UK security training outfit ‘Get Licensed’ survey.

While the GCI captures the current state of global city leadership; the Global Cities Outlook (GCO) aims to identify cities most likely to achieve global prominence. Here, the emergence of a distributed geography of opportunity was also present.

European cities maintained a strong presence in the top 30 rankings, while Asia’s global hubs, including Seoul, Osaka, and Chennai, made significant strides.

In the US, second-tier metropolitan areas performed particularly well, having successfully attracted talent and capital over the turbulent past few years.

Source: Zaway

Egypt-based healthtech Almouneer has raised a $3.6 million Seed round, led by Global Ventures, Proparco and Digital Africa through the Bridge Fund (FRA), Wrightwood Investments (UK) - and other international funds.

Founded in 2017 by Noha Khater and Rania Kadry, Almouneer is a digital transformation platform to serve patients with chronic diseases.

Proceeds to further develop DRU - Almouneer’s patient-centric platform - treating pre-diabetes, diabetes and obesity.

Press release:

Almouneer, the leading digital transformation platform revolutionising healthcare for patients and doctors across the Middle East and Africa (MEA), announces its seed round fundraise of US$3.6 million.

The seed round was led by Dubai-based Global Ventures, with participation from other renowned international investors: Proparco and Digital Africa, through the Bridge Fund, Wrightwood Investments - the family office of Diane & Henry Engelhardt (UK) - and other leading international funds.

The fundraise follows rapid growth for Almouneer as it serves over 120,000 patients, with business volumes having doubled in the last year and its leadership team boosted with several key hires.

The proceeds will primarily support the development and expansion of DRU - MEA's first patient-centric, digitally-enabled lifestyle and diabetes management platform. DRU aids in the prevention and management of diabetes, pre-diabetes, and obesity - and will serve millions in Egypt and MEA. The scalable platform uses cutting-edge patient and doctor-facing applications and an extensive provider network.

Proceeds will enhance DRU’s state-of-the-art technology further and grow its wider provider ecosystem (doctors / health coaches / labs / nutritionists). Almouneer will also build MEA’s first online, patient-customized treatment plans. DRU currently connects to Continuous Glucose Monitors and other glucometers and will soon enable connection to wearables such as smart watches.

2024 is set to be a year of important milestones. In Q1, Almouneer will launch its DRU app for doctors - connecting healthcare providers with millions of patients. The company’s strategy is to expand regionally and internationally - with market entries to Saudi Arabia, the U.A.E., and African countries including Nigeria and Kenya - anticipated by next year.

The MEA region has very high levels of obesity and prediabetes - affecting over 40% of its population - making Almouneer and DRU’s mission to empower patients and healthcare professionals more critical than ever. Egypt has 15 million diabetics alone (20% of adults) with KSA having 7 million (30% of adults). Adding those suffering from pre-diabetes and obesity makes the problem even more endemic yet is largely preventable by lifestyle management and monitoring.

Noha Khater, co-founder and CEO of Almouneer, said: “We are very excited to be announcing this round—an important achievement and milestone in our journey.

Over the past year, we managed to grow our team and successfully build DRU. This round will now catapult us into the next phase of our business, helping us grow our team and talent further, invest in our technology, and broaden DRU’s provider network—inching us even closer to our vision.

And as we do, we’d like to extend our deepest gratitude to our investors—Noor Sweid and Said Murad from Global Ventures, Henry Engelhardt of Wrightwood Investments, and Proparco—for their belief in us and in our mission. We also wouldn’t be here today had it not been for the unwavering support and championing of Cartier Women’s Initiative, INSEAD, Endeavor and our friends at Alliance Law Firm."

Noor Sweid, Founder and Managing Partner of Global Ventures, commented: “We are thrilled to welcome Almouneer to the Global Ventures portfolio and lead the company's seed round.

Over the years, we have had the privilege of working with a stellar group of healthcare entrepreneurs who are materially improving the lives of patients worldwide, enhancing access, quality and cost of care. Noha and Rania are now part of this group. We are excited to work alongside them as they leverage their specialized expertise across business-building and chronic care to tackle a prevalent health issue across the Middle East and Africa.

On its mission to become the lifelong companion of diabetic patients in the region, Almouneer is a unique and necessary innovation.”

Henry Engelhardt, of Wrightwood Investments, commented: "The work Almouneer does is truly valuable to the ever-growing diabetic community in Egypt and beyond.

Noha Khater and Rania Kadry, its two leaders, are truly exceptional, talented people, driven to make a positive difference to so many people’s lives. Wrightwood Investments [the family office of Diane & Henry Engelhardt] is proud to be an investor and part of the Almouneer family.”

Fabrice Perez, Head of VC Division at Proparco, said: “Almouneer is dedicated to fostering innovation and industry disruption through its array of digital services for patients and clinic networks. This objective strongly aligns with the goals of both Proparco and Digital Africa.”

Babacar Seck, CEO of Digital Africa, commented: “Digital Africa welcomes Almouneer to the Bridge Fund portfolio with great enthusiasm, as we are investing in a strategic, high-impact sector. We are delighted to contribute to Noha and her teams, and behind them all the patients for who Almouneer simplifies life.”

Source: Wamda

The private credit fund Ruya Private Capital I LP, run by Ruya Partners, has received a $10 million investment from Saudi Venture Capital (SVC).

Founded in 2020 by Omar Al Yawer, Mirza Beg and Rashid Siddiqi, Ruya Partners is an independent private credit firm that provides funding solutions to private sector companies in developing markets.

The fund will focus on providing capital solutions in the form of private debt instruments to SMEs, with a concentration on mid-market companies, including late-stage venture capital-backed businesses in Saudi Arabia and the region.

Press release:

Saudi Venture Capital (SVC) announced its investment of $10 million in "Ruya Private Capital I LP," a private credit fund managed by Ruya Partners.

The fund will focus on providing capital solutions in the form of private debt instruments to SMEs, with a concentration on mid-market companies, including late-stage venture capital-backed businesses, in Saudi Arabia and the region.

The subscription agreement was signed by Dr. Nabeel Koshak, CEO and Board Member at SVC, and Omar Al Yawer, Partner at Ruya Partners.

The signing ceremony was also attended by Nora Alsarhan, Chief Investment Officer, and Haifa Bahaian, Chief Legal Officer at SVC, as well as Mirza Beg and Rashid Siddiqi, Founding Partners at Ruya Partners.

Dr. Koshak commented: "The investment in the private credit fund managed by Ruya Partners is part of SVC's Investment in Funds Program. The investment also comes as a result of the increasing demand for venture debt and private debt by Saudi startups and SMEs and to implement SVC's strategy related to the launch of the "Investment in Venture Debt Funds and Private Debt Funds" product to fill financing gaps in the ecosystem".

"We are honored to have received this commitment of capital and trust from SVC and look forward to a successful partnership together," stated Omar Al Yawer.

The Founding Partners Mirza Beg and Rashid Siddiqi added: "We firmly believe that offering private credit capital solutions to companies in a manner which is non-dilutive to shareholders will serve as a powerful catalyst for their future growth and should contribute towards the continued expansion and development of the SME ecosystem."

SVC is a government investment company established in 2018 and is a subsidiary of the SME Bank, one of the developmental banks affiliated with the National Development Fund. SVC aims to stimulate and sustain financing for startups and SMEs from pre-Seed to pre-IPO by investing $2 billion through investment in funds and co-investment in startups. SVC invested in 43 funds that have invested in 700+ companies.

Source: Wamda

Talent Acceleration Platform (TAP), a promising startup in the tech industry, has recently announced the successful completion of a seed funding round. Led by Wamda Capital, the round raised an impressive $1 million, highlighting the confidence and support TAP has garnered from investors. This significant investment will undoubtedly propel TAP's growth and enable the company to further develop its innovative solutions.

The Seed Funding Round:

TAP's seed funding round, which closed recently, has been a resounding success. The round was led by Wamda Capital, a renowned venture capital firm known for its strategic investments in high-potential startups. The participation of other notable investors further validates TAP's potential and underscores the market's confidence in the company's vision.

TAP's Innovative Solutions:

TAP has been making waves in the tech industry with its groundbreaking solutions. The company focuses on developing cutting-edge technologies that revolutionize the way businesses operate. TAP's flagship product is a state-of-the-art software platform that streamlines and automates various business processes, enhancing efficiency and productivity.

The Importance of Seed Funding:

Seed funding plays a crucial role in the early stages of a startup's journey. It provides the necessary capital to fuel growth, develop products, and expand the team. TAP's successful seed funding round not only demonstrates the market's belief in the company's potential but also provides the resources needed to accelerate its growth trajectory.

Wamda Capital's Strategic Investment:

Wamda Capital's decision to lead TAP's seed funding round is a testament to the startup's promising future. With its extensive experience and network in the tech industry, Wamda Capital brings more than just financial support to the table. Their strategic guidance and industry expertise will undoubtedly prove invaluable as TAP continues to scale and establish itself as a key player in the market.

Future Prospects:

With the infusion of $1 million in seed funding, TAP is well-positioned to capitalize on the market opportunities and further develop its innovative solutions. The funding will enable the company to expand its team, enhance its product offerings, and accelerate its go-to-market strategy. TAP's future prospects look promising, and the company is poised to make a significant impact in the tech industry.

TAP's successful seed funding round, led by Wamda Capital, marks a significant milestone in the company's journey. The $1 million investment will provide the necessary resources for TAP to continue its growth trajectory and solidify its position as a leading player in the tech industry. With its innovative solutions and strategic partnerships, TAP is poised to make a lasting impact and shape the future of business operations.

About TAP:

TAP founded in 2018, is a Dutch/ Palestinian initiative that provides talented youth in Palestine with 16-week online educational programs to prepare them for remote work with European companies. TAP's programs focus on developing in-demand technical skills and power skills.

Once participants complete TAP's programs, they are connected with potential employers through TAP's network of European companies. TAP's new funding will enable it to expand to other countries in the MENA region in the coming years.

For more information, you can visit their website by clicking here.

Starting a new business can be an exciting and challenging endeavor. As an entrepreneur, you have a vision and a passion for your idea, but turning that idea into a successful startup requires careful planning and execution. In this article, we will explore seven essential tips that can help you navigate the journey of building a successful startup. From identifying your target market to building a strong team, these secrets will provide you with valuable insights and strategies to set your startup on the path to success. So, let's dive in and uncover the secrets of a successful startup!

1. Define Your Target Market

One of the first steps in building a successful startup is to clearly define your target market. Understanding who your customers are, their needs, and their preferences is crucial for developing a product or service that resonates with them. Conduct market research, analyze competitors, and gather feedback from potential customers to gain insights into your target market. This will help you tailor your offerings and marketing strategies to effectively reach and engage your audience.

2. Develop a Unique Value Proposition

In a competitive business landscape, having a unique value proposition is essential for standing out from the crowd. Your value proposition should clearly communicate the benefits and advantages of your product or service compared to others in the market. Identify what sets you apart and why customers should choose your startup over competitors. This will not only attract customers but also attract potential investors who see the potential in your unique offering.

3. Build a Strong Team

Behind every successful startup is a strong and dedicated team. Surround yourself with talented individuals who share your vision and complement your skills. Look for team members who are passionate, motivated, and have expertise in areas that are crucial for your startup's success. A diverse team with a mix of skills and perspectives can bring fresh ideas and innovative solutions to the table.

4. Create a Solid Business Plan

A well-thought-out business plan is a roadmap that guides your startup's growth and success. It outlines your goals, strategies, financial projections, and market analysis. A solid business plan not only helps you stay focused but also serves as a valuable tool when seeking funding from investors or financial institutions. Continuously review and update your business plan as your startup evolves to ensure you stay on track.

5. Secure Sufficient Funding

Securing sufficient funding is often a challenge for startups. Whether it's through bootstrapping, seeking investors, or applying for grants, having access to capital is crucial for fueling your startup's growth. Develop a comprehensive financial plan that outlines your startup's funding needs and explore different funding options available to you. Be prepared to pitch your idea and demonstrate the potential return on investment to attract investors.

6. Embrace Innovation and Adaptability

In today's rapidly changing business landscape, innovation and adaptability are key to staying ahead of the curve. Embrace new technologies, trends, and customer preferences to continuously improve your product or service. Be open to feedback and willing to pivot if necessary. Successful startups are those that can quickly adapt to market demands and seize new opportunities.

7. Focus on Customer Experience

Customer experience is at the heart of any successful startup. Happy and satisfied customers not only become loyal advocates but also contribute to your startup's growth through word-of-mouth referrals. Prioritize delivering exceptional customer service, listen to customer feedback, and continuously improve your offerings based on their needs. Building strong relationships with your customers will not only drive customer loyalty but also attract new customers.

In conclusion, building a successful startup requires a combination of strategic planning, innovation, and a customer-centric approach. By defining your target market, developing a unique value proposition, building a strong team, creating a solid business plan, securing sufficient funding, embracing innovation and adaptability, and focusing on customer experience, you can set your startup on the path to success. Remember, the journey of entrepreneurship may have its challenges, but with the right strategies and mindset, you can turn your startup into a thriving business. So, go ahead, embrace these secrets, and unlock the potential of your startup!

Saudi Arabia and Switzerland hosted the first-ever Saudi-Swiss CleanTech Forum in 2023. The event brought together Swiss companies and small and medium-sized enterprises (SMEs) to showcase innovative solutions to address global challenges, combat climate change, and promote sustainability.

The forum was a partnership between the Embassy of Switzerland in Saudi Arabia, the Research, Development and Innovation Authority (RDIA), and King Abdulaziz City of Science and Technology (KACST). It aimed to boost international trade and economic ties between the two nations.

Discussions at the forum also revolved around the benefits of Saudi Arabia's Vision 2030, which strives to make the country a major industrial power and a global logistics hub.

In his keynote speech, Saudi Arabia's Minister of Economy and Planning, Faisal bin Fadel Al-Ibrahim, highlighted the importance of the partnership between Saudi Arabia and Switzerland, as well as the challenges facing the environment. He also stated that Saudi Arabia is a leading country in the Middle East for private sector investment, with around $5.5 billion invested in 2022.

Al-Ibrahim mentioned several significant projects, including the NEOM green hydrogen projects and a carbon capture facility. The NEOM green hydrogen projects, which are expected to be commissioned in 2026, will be the world's largest green energy facility and will be powered entirely by renewable energy.

Switzerland is known for its innovation and utilizes a "bottom-up" approach, with the government focusing on education and fundamental research to support companies. In an interview with Arab News, Helene Budliger Artieda, Swiss State Secretary for Economic Affairs, explained that the government's primary role is centered on funding a robust education system and supporting fundamental research at universities.

Artieda added that transitioning to a greener world is a key priority for both Saudi Arabia and Switzerland. She highlighted Switzerland's expertise in areas such as railways and water treatment and management. She also mentioned that there are various investment opportunities that Switzerland might be interested in, such as the Kingdom's vast areas, abundant solar parks, and green hydrogen initiatives.

Artieda emphasized the presence of numerous niche opportunities in the Kingdom, including investments in sustainable Saudi fashion. She noted that Switzerland has a well-established textile industry. She also expressed interest in the significant developments occurring in the global fashion industry, implying that Saudi Arabia is eager to align with global trends and standards, particularly those related to sustainability.

On Sunday, Artieda held a meeting with the minister of economy and planning to discuss ways to expand economic relationships, explore the potential for trade and investment collaboration between their respective countries, and review topics of mutual interest. She emphasized the significance of establishing a robust framework to facilitate this cooperation.

Additionally, the Saudi Press Agency reported on Sunday that Saudi Arabia's National Industrial Development and Logistics Program (NIDLP) organized a Saudi-Swiss symposium in Riyadh. The event had several objectives, including shedding light on the Kingdom's economic transformation and exploring investment opportunities between Saudi Arabia and Switzerland.

Saudi Arabia's non-oil exports to Switzerland are valued at around SR3.5 billion ($0.93 billion), while total imports from Switzerland into the Kingdom stand at approximately SR8 billion.

Overall, the Saudi-Swiss CleanTech Forum was a successful event that highlighted the importance of innovation and sustainability in addressing global challenges. The partnership between Saudi Arabia and Switzerland is a positive step towards achieving these goals.

Financing startups in the MENA in September 2030..a relative decline in the volume of financing

29 Oct 2023MINA startups saw a significant drop in funding in September 2023, raising only $36 million across 36 deals. This represents a 64% drop in value month-on-month and a decrease of 82% year-on-year.

In this article, we will discuss financing startups in September 2030, and the challenges they face during this period, and in light of the decline in their financing throughout the year 2030. Rephrase this paragraph

Distribution of funding by country

UAE startups got the most finance in the MENA area in September, raising $27 million from 14 deals. This represents 75% of the total funding for startups in the region during that period. Saudi startups came in second with $2.7 million from 4 deals, followed by Egyptian startups with the same amount, distributed over 7 deals. Tunisian startups raised $1.6 million, while Jordanian and Kuwaiti startups each raised $1 million.

Distribution of funding by sector

Fintech startups in the Middle East and North Africa raised the most funding in September 2023, with $16 million. This was more than double the amount raised by cleantech startups, which came in second place with $6.6 million. E-commerce startups followed closely behind with $6.5 million in funding.

While fintech startups raised the most funding, game startups experienced the biggest growth in funding. Game startups raised $6.2 million in September 2023, which is more than they have ever raised in a single month. This growth in funding suggests that the game sector is becoming increasingly popular in the Middle East and North Africa.

The rest of the funding in September 2023 was spread across a variety of sectors, including advertising, logistics, and healthcare.

MENA STARTUPS FACE CHALLENGES, BUT POSITIVE SIGNS EMERGE!

The decline in funding for startups in the Middle East and North Africa (MENA) region is likely due to several factors, including the global economic slowdown, the rising cost of borrowing, and the ongoing war in Ukraine. Additionally, the region's startup ecosystem is still relatively young and underdeveloped, which may make investors more cautious about investing in the region.

Despite these challenges, there are still some positive signs for the MENA startup ecosystem. Fintech and cleantech are two of the fastest-growing sectors, and there is a growing number of successful startups in these areas. Additionally, investors are investing more in B2B startups than B2C startups, which suggests that investors are optimistic about the region's long-term growth potential.

However, more work needs to be done to support startups in the MENA region. Investors need to be more willing to invest in early-stage startups, and governments in the region need to do more to create an environment that is supportive of entrepreneurs.