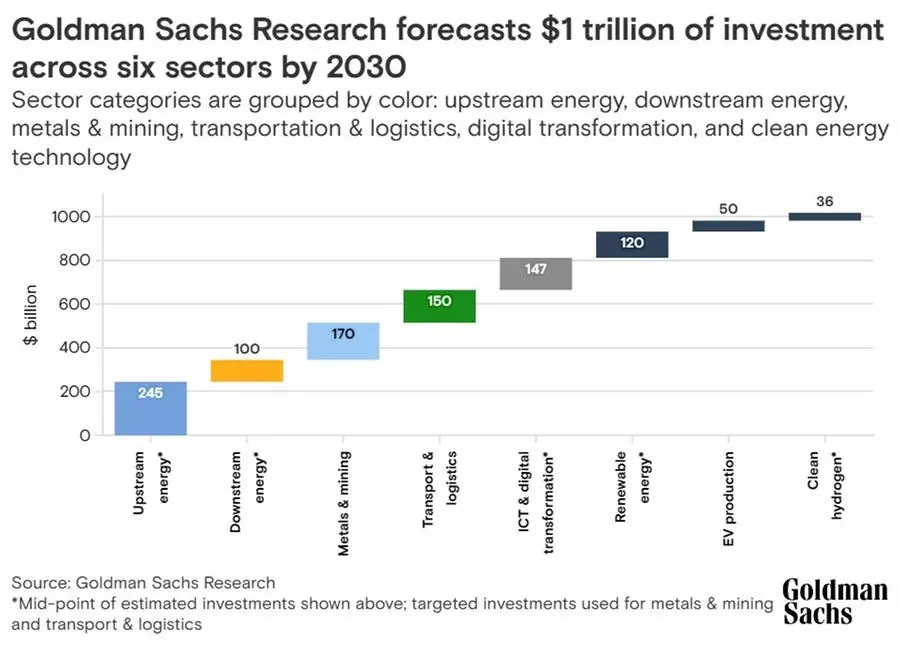

Around $1 trillion worth of preliminary investments will pour into Saudi Arabia’s six key sectors by 2030, as the kingdom implements a wave of reforms to transform its economy, according to Goldman Sachs Research.

Of the estimated investments, which are part of the $3.3 trillion targeted by the kingdom’s National Investment Strategy (NIS), $245 billion will be spent on upstream energy, while $100 billion and $170 billion will go to downstream energy, and metals and mining, analysts at the global investment banking said.

The transport and logistics sector will see around $150 billion, while total investments in ICT and digital transformation will reach $147 billion. Renewable energy, EV production and clean hydrogen will see investments reach around $120 billion, $50 billion and $36 billion, respectively, through the end of the decade.

The said sectors are already benefiting from increased investment, Goldman Sachs noted, adding that they are likely to drive a “capex supercycle” through the end of the decade.

“Within six strategic sectors, we see scope for nearly $1 trillion in preliminary investments through the end of the decade across investment programs, with more projects to be announced in tandem with technological progress and as Saudi accelerates execution of mega-projects and smart cities,” wrote Goldman Sachs Research analyst Faisal AlAzmeh in a team report.

In one of its latest briefings, Goldman Sachs noted that Saudi Arabia’s focus on diversifying its economy is already showing results.

The kingdom launched NIS in 2021 as a crucial enabler for achieving Vision 2030, the government’s blueprint for economic transformation. Its focus is to strengthen the role of foreign direct investment (FDI), which is expected to grow to 3.4% of GDP by 2025 and 5.7% by 2030.

A key pillar of the NIS is Shareek, a 2021 program that seeks to expand domestic investment made by private sector businesses to $1.3 trillion by 2030.

Some of the plans to boost investments

Among the sectors in focus, Saudi’s clean technology is set to see additional 60 gigawatts of renewable energy capacity and two to three GW of nuclear energy capacity by 2030.

In metals and mining, Saudi Arabia announced a new investment law in 2021 to facilitate the issuance of mining licenses and leverage an estimated $1.3 trillion worth of metals and minerals that are said to be “vastly unexplored”.

To boost its transportation and logistics sector, Saudi launched recently an updated National Transport and Logistics Strategy, a Saudi Aviation Strategy and a new national airline. There are also plans to expand the King Salman International Airport.

As for digital transformation, the country’s telecommunications providers are focused on network capacity expansion, particularly 5G and fiber-to-home services.

source: Zawya

Saudi Arabia has launched investments worth $6.4 billion in future technologies, the Saudi minister of communication and information technology said on Tuesday, as the kingdom races to diversify its economy from oil in the face of fierce regional competition.

Wealthy Gulf countries have launched initiatives to boost non-oil growth and reduce dependence on crude oil as climate change campaigners and volatility in oil prices have put pressure on government finances.

The kingdom has already announced it is pouring hundreds of billions of dollars into an economic transformation, known as Vision 2030, led by its de facto ruler Crown Prince Mohammed bin Salman

The investments announced on Tuesday include a $2 billion joint venture between eWTP Arabia Capital, a fund backed by Saudi Arabia's sovereign wealth fund, the Public Investment Fund (PIF) and Alibaba, and China's J&T Express Group, minister Abdullah Alswaha said.

Saudi oil giant Aramco will inject, via its fund Prosperity7 Ventures, $1 billion to help entrepreneurs across the globe build transformative start-ups, while Saudi Telecom Co (STC) 7010.SE will invest $1 billion in the infrastructure of submarine cables and data centres, he said.

"Right now, the tech and digital market in the kingdom is around $40 billion which is the largest by far in the region. We're very proud of the growth that we have seen in the region, specifically in areas around e-commerce, gaming, digital content and cloud," Alswaha said in a interview with Reuters.

The minister, who was speaking on the margins of LEAP, an international technology platform taking place in Riyadh, said Armaco Prosperity7's initiative will focus on green technologies while logistics company J&T Express Group's joint venture will build a smart hub for the region that will improve efficiency by up to 100%.

Alswaha said NEOM, a futuristic megacity that the crown prince is building on the Red Sea coast, has launched $1 billion of investments in a metaverse to serve the city's residents and visitors, in addition to another platform that would help users to take control of their personal data.

"We project over the next eight years, a minimum of another 100,000 to 250,000 jobs, which will effectively mean doubling the number of coders that we have today, in some cases will triple (the number)," he said.

The government also expects $1.4 billion to be spent in entrepreneurship and allocated to funds to support digital content, including an initiative known as The Garage, a space in the capital Riyadh that will host start-ups specialised in new technologies.

"All the numbers ... are vetted and validated by third parties. Again, we are not in the business of any showmanship, we're in the business of committing and delivering," the minister said.

Source: zawya

Middle Eastern fund managers plan to increase investments in Saudi Arabia in the current quarter, according to a Reuters poll, betting on the kingdom's ability to bounce back from the coronavirus and low oil price shocks.

The region, which has imposed strict lockdown measures as it deals with the outbreak, is home to many oil producers, who have seen the price of their main resource tumble as they spend to help support their economies.

Half of the eight fund managers polled by Reuters said they would increase their allocations in Saudi Arabia, the Gulf's largest economy.

While Saudi Arabia's main stock index <.TASI> is down 11% this year, it is up 3.25% this quarter. In a separate Reuters poll this month, the oil producer's GDP was seen shrinking 5.2% this year, before rebounding next year.

"We are looking for opportunities ... across sectors less impacted by both the oil price slump and the pandemic," said Jai Lawrence, asset management analyst at Almal Capital.

While some large companies in Saudi Arabia have taken a hit, the country is "a more diversified market with stock-specific opportunities available, which could be drivers of portfolio returns," said Emirates NBD's Dipanjan Ray, citing the potential merger of the kingdom's banks NCB and Samba.

Overall, fund managers said they were keeping their allocations in the UAE unchanged, because while the pandemic has hurt sectors such as real estate and tourism, the diversified nature of its economy could boost recovery.

"At this stage we believe the Dubai market has already discounted a lot of the negative consequences of the current crisis and there is medium to long-term upside," said Mohamed Jamal of Waha Capital.

Three of the managers polled increased allocations for Kuwait, drawing on its inclusion in the MSCI emerging markets index in November.

They said the timeline of the recovery was uncertain but Emirates NBD's Ray said he expected economic activity to normalise across all sectors over the next 12 months.

He said his firm had invested defensively going into the pandemic crisis, but "we have rotated into high-quality recovery-oriented names."

source: money.usnews