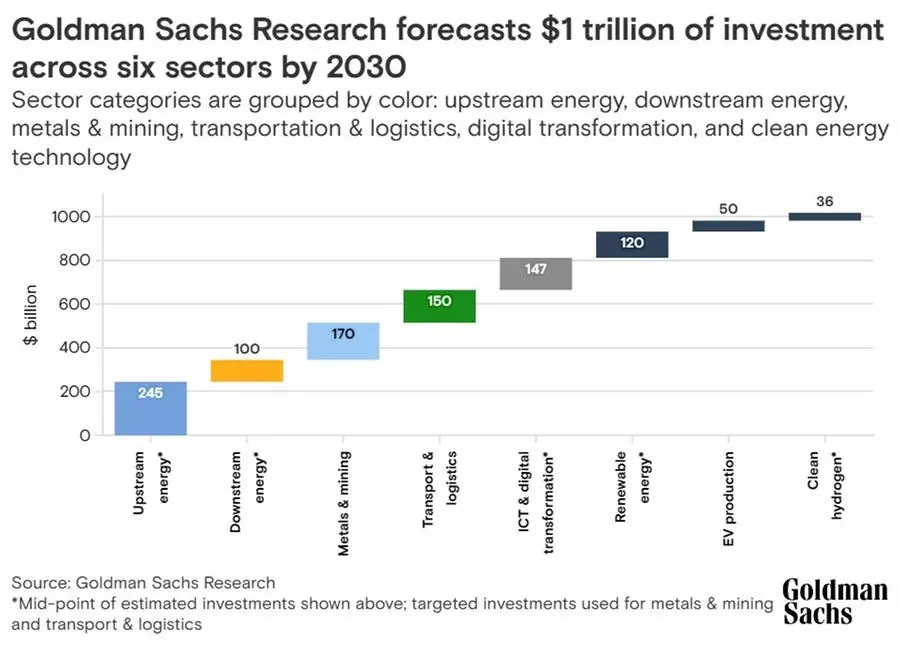

Around $1 trillion worth of preliminary investments will pour into Saudi Arabia’s six key sectors by 2030, as the kingdom implements a wave of reforms to transform its economy, according to Goldman Sachs Research.

Of the estimated investments, which are part of the $3.3 trillion targeted by the kingdom’s National Investment Strategy (NIS), $245 billion will be spent on upstream energy, while $100 billion and $170 billion will go to downstream energy, and metals and mining, analysts at the global investment banking said.

The transport and logistics sector will see around $150 billion, while total investments in ICT and digital transformation will reach $147 billion. Renewable energy, EV production and clean hydrogen will see investments reach around $120 billion, $50 billion and $36 billion, respectively, through the end of the decade.

The said sectors are already benefiting from increased investment, Goldman Sachs noted, adding that they are likely to drive a “capex supercycle” through the end of the decade.

“Within six strategic sectors, we see scope for nearly $1 trillion in preliminary investments through the end of the decade across investment programs, with more projects to be announced in tandem with technological progress and as Saudi accelerates execution of mega-projects and smart cities,” wrote Goldman Sachs Research analyst Faisal AlAzmeh in a team report.

In one of its latest briefings, Goldman Sachs noted that Saudi Arabia’s focus on diversifying its economy is already showing results.

The kingdom launched NIS in 2021 as a crucial enabler for achieving Vision 2030, the government’s blueprint for economic transformation. Its focus is to strengthen the role of foreign direct investment (FDI), which is expected to grow to 3.4% of GDP by 2025 and 5.7% by 2030.

A key pillar of the NIS is Shareek, a 2021 program that seeks to expand domestic investment made by private sector businesses to $1.3 trillion by 2030.

Some of the plans to boost investments

Among the sectors in focus, Saudi’s clean technology is set to see additional 60 gigawatts of renewable energy capacity and two to three GW of nuclear energy capacity by 2030.

In metals and mining, Saudi Arabia announced a new investment law in 2021 to facilitate the issuance of mining licenses and leverage an estimated $1.3 trillion worth of metals and minerals that are said to be “vastly unexplored”.

To boost its transportation and logistics sector, Saudi launched recently an updated National Transport and Logistics Strategy, a Saudi Aviation Strategy and a new national airline. There are also plans to expand the King Salman International Airport.

As for digital transformation, the country’s telecommunications providers are focused on network capacity expansion, particularly 5G and fiber-to-home services.

source: Zawya