News

Transforming B2B Travel Tech: Tumodo's Groundbreaking Pre-Seed Funding

20 Jan 2024 Written by Admin AdminIn the dynamic landscape of B2B travel technology, Tumodo has emerged as a trailblazer, securing a remarkable $3.5 million in pre-seed funding. This significant milestone not only underscores Tumodo's potential but also signals a new era of innovation and growth within the travel tech sector. In this comprehensive article, we will delve into the unique value proposition of Tumodo's platform, the implications of its pre-seed funding, and the transformative impact it is poised to have on the B2B travel industry.

Unveiling Tumodo's Vision

Tumodo's vision is rooted in redefining the B2B travel landscape by offering a comprehensive and seamless platform that caters to the diverse needs of travel industry stakeholders. Through the integration of cutting-edge technology and a customer-centric approach, Tumodo aims to revolutionize the way businesses engage with travel services, ultimately driving efficiency and enhancing the overall travel experience.

The Power of Pre-Seed Funding

The successful raise of $3.5 million in pre-seed funding represents a pivotal moment for Tumodo, signifying not only investor confidence but also the potential for accelerated growth and innovation. This infusion of capital will enable Tumodo to further develop its platform, expand its market reach, and solidify its position as a frontrunner in the B2B travel tech space. The funding will also fuel research and development efforts, allowing Tumodo to introduce new features and capabilities that cater to the evolving needs of its clientele.

Redefining B2B Travel Engagement

Tumodo's platform serves as a catalyst for redefining B2B travel engagement, offering a suite of tools and solutions that empower businesses to streamline their travel operations. From seamless booking processes to advanced analytics and reporting, Tumodo's platform is designed to optimize efficiency, reduce costs, and provide unparalleled visibility into travel-related activities. This not only enhances the operational capabilities of businesses but also fosters stronger partnerships within the travel ecosystem.

Driving Innovation and Collaboration

The infusion of pre-seed funding positions Tumodo to drive innovation and collaboration within the B2B travel tech sector. By leveraging the capital to enhance its technological infrastructure and expand its service offerings, Tumodo is poised to set new industry standards, fostering a culture of innovation and excellence. Furthermore, the funding will enable Tumodo to forge strategic partnerships and alliances, creating a network of synergistic relationships that further elevate the value proposition for its clients.

The Future of B2B Travel Technology

As Tumodo embarks on this transformative journey fueled by pre-seed funding, it is poised to shape the future of B2B travel technology. With a steadfast commitment to innovation, customer satisfaction, and industry leadership, Tumodo is well-positioned to drive meaningful change, setting new benchmarks for operational efficiency, collaboration, and value creation within the B2B travel landscape.

In conclusion, Tumodo's groundbreaking pre-seed funding marks a significant milestone in the evolution of B2B travel technology, propelling the company towards a future defined by innovation, collaboration, and unparalleled value delivery. As Tumodo continues to redefine the B2B travel landscape, its platform stands as a testament to the transformative power of technology and strategic investment in driving industry-wide progress.

From Electronics to Cars: Soum Takes Re-commerce Beyond Borders with $18 Million

03 Jan 2024 Written by Admin AdminSaudi Arabia-based re-commerce marketplace Soum has successfully raised $18 million in a Series A funding round, with Jahez leading the investment and participation from Isometry Capital, Khwarizmi Ventures, Alrajhi Partners, and Outliers Venture Capital. Founded in 2021 by Fahad Al Hassan, Fahad Albassam, and Bader Almubarak, Soum serves as a platform for SMEs and individuals to sell their secondhand products.

The latest funding will enable Soum to expedite its regional expansion plans and diversify beyond its core vertical of secondhand electronics. The company aims to broaden its offerings to include products ranging from collectibles to automobiles, tapping into a combined market worth $40 billion.

Since its inception, Soum has experienced remarkable growth, with sales increasing by 40 times and maintaining exceptional unit economics and customer satisfaction scores. The platform has facilitated transactions to and from over 150 Saudi cities, establishing a unified national marketplace for buying, selling, and discovering products with trust and convenience. The Soum app, launched less than two years ago, has garnered over 4 million downloads in the Kingdom of Saudi Arabia and is gaining traction in the United Arab Emirates.

Fahad Alhassan, Co-Founder & CEO of Soum, expressed the company's vision to be the go-to marketplace for buying and selling anything online with convenience and trust. The successful funding round reflects the dedication of the entire team and signifies the commencement of the next phase of growth, aligning with the mission to revolutionize online buying and selling.

Soum acts as a trusted intermediary for each transaction, alleviating the challenges faced by buyers and sellers in the MENA region when navigating spam-infested classified platforms. This approach ensures a seamless and secure transaction experience for all parties involved.

Abdulaziz Alhouti, Chief Investment Officer of Jahez, commended the remarkable achievements of the Soum team, emphasizing their dedication to innovation and customer satisfaction. The investment reflects confidence in Soum's potential to redefine the e-commerce landscape in the Middle East.

With the Series A funding as a catalyst, Soum is poised for continued growth, aiming to set new standards in innovation, customer satisfaction, and market impact in the Middle East. The Soum mobile app is available on the Apple App Store and Google Play Store, offering a seamless platform for buying and selling secondhand products with convenience and trust.

Source: News

Tameed Secures $15 Million to Fuel SME Lending Platform in Saudi Arabia

03 Jan 2024 Written by Admin AdminSaudi Arabia-based fintech company Tameed has successfully secured a substantial $15 million in a Series A funding round, with Alromaih Investments leading the investment. Established in 2019 by Mohammed Al Alshaikh and Mohammed Alomayyer, Tameed specializes in providing SMEs with P2P Shariah-compliant financing options for their government contract purchases through its digital platform.

The infusion of new capital will enable Tameed to expedite its expansion and cater to the growing demand for its digital lending products. The company, which obtained its operating license from the Saudi Central Bank (SAMA) in January 2023, has been operating within SAMA’s FinTech SandBox. Tameed has facilitated SME funding exceeding SAR 400 million, serving investors and borrowers through a mobile app with 50,000 downloads, and achieving a growth rate exceeding 400%.

Tameed's commitment to providing transparent pricing and swift loan processing, completed within three business days through a fully digitalized process, has earned the trust of its clients. The company's focus on efficiency in processing and customization of services translates into tailored products aimed at supporting SMEs in fulfilling their purchase order commitments.

Mr. Mohammed Alomayyer, the CEO and co-founder of Tameed, expressed optimism about the Kingdom’s economic growth and emphasized Tameed's dedication to meeting the needs of SMEs by offering innovative funding products. He highlighted the addition of performance bond financing for projects to serve a wider range of SMEs and support their effective participation in major projects.

Mr. Omar Alromaih, the CEO of Investments at Alromaih Group, underscored the belief in the opportunity and the sector, expressing anticipation for Tameed's continued growth and expansion of investment and funding opportunities to address the financing needs of SMEs and bridge the funding gaps created by Vision 2030 programs and projects.

Furthermore, Alromaih Group's strategy focuses on diversifying investment tools and risk mitigation through acquisitions, transactions, and investment rounds into the FinTech Division, recognized as one of the most promising and targeted sectors in the Kingdom’s Vision 2030.

Mr. Mohammed Al Alshaikh, the co-founder of Tameed, emphasized that the funding round will facilitate the company's growth to serve investors and SMEs requiring funding while innovating on the best technologies and products. He highlighted the recent launch of an Auto-Invest product designed to enable busy investors to engage in short-term funding opportunities based on pre-configured investment preferences.

Source: News

Modus invests $2.8 million in eight startup launches through its Venture Builder platform

25 Nov 2023 Written by Admin AdminUAE-based Modus Capital has announced the launch of eight new startups as part of its venture builder programme, investing $2.8 million across these newly-launched ventures.

These startups include JamaliBox, MDBX, Monet, Oscar, Seva, Sindbad, Stornest, and Your Social Smile.

Modus operates a network of venture builders anchored by a $50 million Venture Builder Fund with programmes located in Abu Dhabi, Riyadh, and Cairo.

The Modus’ venture-building approach involves a nine-month programme designed to empower established and new founders through financial and non-financial offerings, including mentorship and access to networking opportunities, among other resources.

Press release

Modus, the Venture Platform comprising VC funds, Venture Builders, and a Corporate Innovation arm in MENA, has announced the successful build and launch of eight startups from its Venture Builder (VB) programs in 2023, investing a total of $2.8M across these emerging companies.

The platform's venture building approach involves a nine-month program designed to empower founders to collaborate with Modus’ operational experts in co-building ideas into fully operational and investable companies. Throughout their participation, founders test and validate ideas, gain access to unparalleled tech support and strategic mentorship, while developing MVPs ready for the market.

Modus operates a network of venture builders anchored by a $50M Venture Builder Fund with programs located across the MENA region in Abu Dhabi, Riyadh, and Cairo. Each location has its own robust venture building frameworks, strategic goals, and serves as regional ecosystems for startups to build out scalable ideas and products, network and knowledge-share with fellow entrepreneurs, and ultimately drive innovation.

Startups across Modus’ VBs benefit from an investment, which includes a combination of capital and in-kind services. From supplementing product, marketing, engineering, design, research, and strategy teams to a dedicated budget for growth initiatives and market validation, Modus provides essential resources to ensure its startups have the best chance of success.

The eight startups built and launched are:

JamaliBox: A monthly beauty box subscription service that delivers curated beauty, skincare, and hair care products across the UAE.

MDBX: A Healthtech merging chronic condition care and medication management with a digital pharmacy linked to robotics.

Monet: A revenue-based financing platform that allows companies to transform their revenue streams into upfront capital, instantly and without dilution.

Oscar: A tailored, automated sustainable procurement tool for the MENA region, considering local culture, business practices, and sensitivities.

Seva: An app that is designed to imitate and simplify the creation of the KHDA process in a user-friendly, digital setting.

Sinbad: A KYC solution for Umrah and emerging markets, giving suppliers the ability to view key data about their pilgrims through its AI-powered verifications.

Stornest: A digital tool that helps individuals plan and store their legacy information and documents to which designated beneficiaries get access in case of an untimely passing.

Your Social Smile: A dental digital marketing tool that modernizes dental experiences and helps improve communication and set procedural expectations between doctors and patients.

Awad Makkawi, Director of Venture Building at Modus said, “The growth of the startups in our VBs is a testament to the collaborative efforts between our founders and venture building experts. With the foundation set, I’m confident that their missions and products will resonate with customers and potential investors, paving the way for further success and funding.”

Modus will remain committed to supporting each startup, particularly with introductions to its network and facilitating access to follow-on investment opportunities from Modus’ VC fund and other investors.

In 2024, Modus is targeting the launch of 6-8 companies, leveraging a pre-existing pipeline of ideas and entrepreneurs in its venture builders. The platform is also welcoming new applications. Modus’ venture builders are nine month tailored programs.

Source: Mouds

Lebanese agritech Dooda Solutions wins $100,000 grant from PepsiCo Greenhouse Accelerator

25 Nov 2023 Written by Admin AdminLebanon-based agritech Dooda Solutions is set to receive a $100,000 grant after being named the winner of this year’s PepsiCo Greenhouse Accelerator: Mena Sustainability Edition.

Founded in 2018 by Nada Ghanem, Dooda Solutions, specialises in producing premium-grade vermicompost, and organic fertilisers on a commercial scale. Its nutrient-rich vermicompost enhances soil fertility and improves crop productivity.

The six-month-long programme is held in partnership with the UAE Ministry of Climate Change and Environment (MOCCAE) and Food Tech Valley (FTV).

Press release

PepsiCo has announced Lebanon-based startup Dooda Solutions as the winner of the second iteration of its Greenhouse Accelerator Program: MENA Sustainability Edition, in partnership with the UAE Ministry of Climate Change and Environment (MOCCAE) and Food Tech Valley (FTV). Dooda Solutions was selected from over 180 applicants, following a rigorous multi-stage selection process and six-months of mentorship, and will receive a $100,000 grant, along with a host of other benefits, to scale their sustainable agricultural solution and grow their business.

Dooda Solutions, a woman-led earthworm farm, specialises in producing premium-grade vermicompost (organic fertilisers) at commercial scale. Its nutrient-rich vermicompost restores soil health by improving its structure, increasing nutrient availability, and enhancing microbial activity. In the program’s final stages, the team demonstrated a truly innovative and scalable solution with a commitment to pushing the boundaries of sustainable agriculture innovations.

The winner was announced at the closing ceremony held at Museum of the Future, following pitches and a product showcase by each startup. The event drew participation from His Excellency Eng. Mohammed Mousa Alameeri, Assistant Undersecretary for the Food Diversity Sector at the Ministry of Climate Change and Environment, and Lāth Carlson, Executive Director of Museum of the Future. The expert judging panel comprised His Royal Highness Prince Khaled bin Alwaleed bin Talal Al Saud, Founder and CEO of KBW Ventures; Sheikh Dr. Majid Al Qassimi, Founder & Partner of Soma Mater Management Consultancies; Wael Ismail, Vice President for Corporate Affairs at PepsiCo Africa, Middle East and South Asia; Alanoud Al Hashmi, CEO of SDG GLOBAL & Futurist; and George Shenouda, Africa Lead, Development and Investment at Masdar.

The program this year focused on sustainable agriculture in line with PepsiCo’s sustainability strategy, pep+ (PepsiCo Positive). The AgriTech industry in MENA has attracted around $250 million in funding in 2022, instilling confidence in regional start-ups and their innovation potential for sustainable agriculture.

The Greenhouse Accelerator Program has created new growth opportunities in this space, helping the startup ecosystem flourish.

“At the heart of our nation’s priorities lies the commitment to food security and sustainable agriculture. As we prepare to host the 28th United Nations Climate Change Conference, Conference of the Parties (COP28), later this month, we recognise the significance of addressing global challenges through innovation and collaboration. We are prioritising the acceleration of efforts to achieve the objectives of the UAE’s National Food Security Strategy 2051 through partnerships and solutions that bring a paradigm shift in the agricultural sector and food systems.

One such initiative is the Greenhouse Accelerator Program as it provides a stage for entrepreneurs and startups to shed light on their pioneering solutions, driving the cause of sustainability, while fostering innovation. I commend all participants for bringing forth their innovative solutions, and PepsiCo, Food Tech Valley, and all partners involved for their dedication to this initiative.

I’m confident that together, we will enhance the resilience and sustainability of the food sector – paving the way for a more sustainable future for all,” said His Excellency Eng. Mohammed Mousa Alameeri, Assistant Undersecretary for the Food Diversity Sector – Ministry of Climate Change and Environment.

“Building on the success of the first edition of our MENA Greenhouse Accelerator, this year marked a significant step towards accelerating progress in sustainable agriculture in the region. As part of our commitments to achieve net-zero emissions by 2040 and become net water positive by 2030, we are actively facilitating innovation to drive tangible change at scale. At PepsiCo, we are dedicated to supporting innovators and entrepreneurs who are at the forefront of sustainable solutions. By providing them with a wealth of resources and offering them a platform to showcase their solutions on global stages, such as at COP28, we want to help them thrive.

We’re excited about Dooda Solution’s potential to transform the regional agriculture sector and look forward to creating more opportunities for other promising startups that will have a lasting positive impact on society,” said Aamer Sheikh, CEO at PepsiCo Middle East.

“It is a huge honour to be recognised by PepsiCo’s Greenhouse Accelerator Program: MENA Sustainability Edition. This journey has been transformative, providing our business with invaluable insights, mentorship, and tools to refine and scale our sustainable agriculture solution.

The program’s extensive reach and network have helped us connect with like-minded entrepreneurs, potential partners, and investors who share our vision for sustainable agriculture, not only accelerating our growth but also reinforcing our commitment to driving sustainable change in the MENA region. We are excited about the journey ahead and remain committed to scaling our operations effectively to provide sustainable solutions to all,” said Nada Ghanem, Founder and Managing Director at Dooda Solutions.

All start-ups that participated in the program received an initial grant of $20,000 and one-on-one mentorship from PepsiCo and external partners over a six month span, who guided them on everything from research and development to business models, marketing, and fundraising.

In addition, six companies selected from both cohorts of the Greenhouse Accelerator Program: MENA Sustainability Edition will be featured in a dedicated showcase at COP28 in Dubai. The move will expand the growing businesses opportunities for growth and strengthen the program’s legacy.

Source: Wamda

World Bank anticipates 4.5% growth in UAE's non-oil economy in 2023

24 Nov 2023 Written by Admin AdminThe World Bank anticipated increase in the UAE's current account balance to 12.4% in 2023 and 11.8% in 2024

RIYADH: The World Bank has projected a 3.4% growth in the real Gross Domestic Product (GDP) of the UAE by the year 2023, with expectations of further increase to 3.7% in 2024.

According to the recently published World Bank Gulf Economic Update (GEU) report, the Bank anticipated the UAE's non-oil GDP growth to reach 4.5% in 2023, driven by strong performances in the tourism, real estate, construction, transportation, and manufacturing sectors, along with increased capital expenditure. Meanwhile, the oil GDP is expected to grow by 0.7% in 2023, rising to 3.6% in 2024.

The World Bank anticipated increase in the UAE's current account balance to 12.4% in 2023 and 11.8% in 2024. The UAE is expected to achieve a surplus in the fiscal balance by 5.2% in 2023 and 4.6% in 2024.

According to the report, the Gulf Cooperation Council (GCC) region is estimated to grow by 1% in 2023 before picking up again to 3.6 and 3.7% in 2024 and 2025, respectively. This growth compensated for by the non-oil sectors, which are expected to grow by 3.9% in 2023 and 3.4% in the medium term supported by sustained private consumption, strategic fixed investments, and accommodative fiscal policy.

Khaled Alhmoud, Senior Economist at the World Bank, said that the diversification and the development of non-oil sectors has a positive impact on the creation of employment opportunities across sectors and geographic regions within the GCC.

“GCC countries have witnessed a remarkable increase in female labour force participation,” said Johannes Koettl, Senior Economist at the World Bank. “Saudi Arabia’s achievements in advancing women’s economic empowerment in just a few years is impressive and offers lessons for the MENA region and the world.”

According to the report, the Saudi private sector workforce has grown steadily, reaching 2.6 million in early 2023. Additionally, the labour force participation of Saudi women more than doubled in a span of six years, from 17.4% in early 2017 to 36% in the first quarter of 2023.

Source: zawya

71% of consumers in Saudi Arabia confident about the future, surpassing global average: study

24 Nov 2023 Written by Admin AdminThe comprehensive study, spanning 19 markets worldwide, delves into the preferences and behaviors of consumers in the KSA, providing valuable insights into their outlook compared to their global counterparts

JEDDAH — In a positive spot in the world, Saudi Arabia radiates an optimistic glow, as a remarkable 71% of its population expresses confidence in the future. Surpassing the global average of 43%, this buoyant consumer sentiment unfolds in the latest Toluna Global Consumer Barometer.

The comprehensive study, spanning 19 markets worldwide, delves into the preferences and behaviors of consumers in the KSA, providing valuable insights into their outlook compared to their global counterparts.

The research indicates that a substantial 64% of KSA residents report heightened satisfaction with their current life and a greater sense of optimism about their future, surpassing the global average of 45%.

However, a noteworthy 25% of residents express concerns over personal financial security, attributing them to prevailing global and economic circumstances.

In response to economic uncertainties, KSA residents are taking proactive steps in financial planning. Notably, 29% plan to reduce spending on books and magazines, recognizing the abundance of online resources.

Similarly, 28% intend to cut back on luxury product or service expenses, while 24% will trim their entertainment and subscription budgets.

Additionally, 22% are opting to dine out less, 22% will curtail leisure activities and hobbies, 19% plan to spend less on vacation holidays, and 20% will refrain from buying new cars.

Looking ahead, the study sheds light on anticipated grocery shopping behavior in the next three months. Key drivers for KSA consumers include price, health, product availability, and quality.

Moreover, 45% of shoppers plan to reduce unnecessary purchases, and 39% will compare prices online and offline.

Other strategies include shopping more often to avoid waste and secure the best deals (31%), visiting more stores in search of value (28%), shopping less often but in bulk (30%), switching to cheaper brands (26%), and adjusting the number of snacks purchased (28%).

Georges Akkaoui, enterprise account director & office leader MEA at Toluna, commented on the findings, stating, "These findings reflect the current economic sentiment and consumer behavior in the KSA.

“Amidst positive signals, consumers are seeking value and reliability in their choices. Brands prioritizing quality, affordability, and sustainability will resonate most with today's savvy shoppers."

The study also outlines anticipated spending behavior in the coming quarter, with 26% planning to allocate more towards groceries, 19% towards mobile phones, 26% towards vitamins and minerals, 23% towards food takeaway, 19% towards sports and fitness, 18% towards life insurance, private health insurance (19%), and gaming (15%).

Source: Zawya

UAE Mobility and Logistics Startup Wize Raises $16 Million in Pre-Seed Round

24 Nov 2023 Written by Admin AdminWize, a UAE-based logistics startup, has successfully raised $16 million in a pre-Seed funding round led by angel investors. This significant investment will fuel the growth and development of Wize's eco-friendly last-mile transportation solutions in the region.

Revolutionizing Last-Mile Delivery with Sustainable Solutions

Founded in 2022 by Alexander Lemzakov, Wize is dedicated to providing sustainable last-mile delivery solutions. The startup offers two core services: a marketplace for electric motorcycles and a subscription platform for businesses to manage their own fleets. Additionally, Wize provides battery-as-a-service and swapping stations, along with a Battery Swap App that allows drivers to reserve batteries in advance and stay informed about charge levels.

Funding for Expansion and Partnership Opportunities

The newly secured funds will be allocated towards product development, strengthening Wize's presence in the UAE market, and exploring new partnership opportunities in the Middle East and North Africa. Wize aims to enhance its offerings and expand its reach, ensuring that more businesses can benefit from their comprehensive ecosystem of sustainable delivery solutions.

A Comprehensive Ecosystem for Sustainable Delivery

Unlike its competitors, Wize has developed a comprehensive ecosystem that aligns with the UAE's net-zero requirements and the UAE Green Agenda. The startup's services include electric motorcycles tailored to meet courier transport regulations, a rental and subscription platform for business owners to manage their fleets, battery-swapping stations, and software components for efficient battery management.

Wize's subscription-based electric motorcycles not only contribute to environmental sustainability but also help businesses reduce transportation costs by up to 30% per month. The Wize Rental and Subscription Online Platform enables clients to manage their fleets 24/7, gathering valuable data on driver behavior, location, speed, and charge levels. Additionally, Wize's battery-swapping stations, known as Wize Power, provide drivers with a convenient way to exchange batteries, ensuring uninterrupted delivery operations.

With a focus on software, Wize has developed its own platform to manage battery swapping stations and monitor the condition of all batteries. This software is fully compliant with local laws, and all data is stored within the UAE, ensuring data security and compliance.

Wize is actively pursuing partnerships with renowned delivery companies in the region. The startup has already established a long-term partnership with Motoboy, the UAE's first sustainable logistics firm, with the shared goal of achieving zero-carbon emissions through the exclusive use of electric bikes. By collaborating with industry leaders, Wize aims to drive real change towards a more sustainable last-mile delivery ecosystem.

In conclusion, Wize's successful $16 million pre-Seed funding round marks a significant milestone for the UAE-based startup. With a focus on sustainability and innovation, Wize is poised to revolutionize last-mile delivery in the region. The investment will support the company's expansion, product development, and exploration of new partnership opportunities, ultimately contributing to a more sustainable and efficient delivery landscape in the UAE and beyond.

نجوم العلوم يفتح باب التسجيل للاشتراك في موسمه الـ16 للمبتكرين العرب

12 Nov 2023 Written by Admin Adminأعلن برنامج "نجوم العلوم" عن فتح باب التسجيل للاشتراك في موسمه الـ16 للمبتكرين العرب!

عن برنامج "نجوم العلوم"

على مدى 15 عاماً من النجاح، عزّز "نجوم العلوم" - وهو برنامج رائد في مجال الابتكار، وإحدى مبادرات مؤسسة قطر التي تندرج في إطار تلفزيون الواقع التعليمي الترفيهي – مكانته على رأس البرامج التي تروم تمكين المبتكرين من مختلف البلدان العربية من تحويل الأفكار المبتكرة إلى حلول ملموسة، بما يرسي ثقافة الابتكار بين أوساط الشباب العربي. فعلى مدى مساره التي انطلق منذ عام 2009، أسهم البرنامج في تطوير حلول تكنولوجية لمجتمعاتهم تعود بالنفع على صحة الناس وأساليب حياتهم، وكذلك في تطوير فرص اقتصادية لأفراد مجتمعاتهم وتعزيز التنمية المستدامة.

يقوم المتسابقون على مدار إثني عشر أسبوعاً بتطوير وعرض حلولهم عبر تجارب علمية، ضمن مساحة ابتكار مشتركة، مع الأخذ بعين الاعتبار السرعة في التنفيذ والاستفادة من الإرشاد والدعم الذي يقدمه فريق من المهندسين ذوي الخبرة ومطوري المنتجات.

في كل أسبوع، تقوم لجنة من الخبراء بتقييم وانتقاء مشاريع المبتكرين الواعدين ونماذجهم الأولية من خلال جولات الاختبار، ليتم في نهاية المطاف الإبقاء على ثلاثة مرشحين من أجل التنافس على اللقب والجائزة الكبرى. تعتمد التصفيات على مداولات لجنة التحكيم وتصويت الجمهور عبر الإنترنت لتحديد الفائزين بالمركز الأول والثاني في كل موسم.

إذا كنت من الراغبين بالدخول في المنافسة في الموسم السادس عشر من برنامج "نجوم العلوم" والحصول على فرصة الفوز بلقب أفضل مبتكر عربي، فيمكنك التسجيل مباشرة على الرابط الآتي: https://www.starsofscience.info/ar مع العلم أن الموعد النهائي للتسجيل في الموسم الجديد هو 1 كانون الأول/ديسمبر 2023.

نبذة عن مؤسسة قطر – إطلاق قدرات الإنسان:

مؤسسة قطر للتربية والعلوم وتنمية المجتمع هي منظمة غير ربحية تدعم دولة قطر في مسيرتها نحو بناء اقتصاد متنوع ومستدام. وتسعى المؤسسة لتلبية احتياجات الشعب القطري والعالم، من خلال توفير برامج متخصصة، ترتكز على بيئة ابتكارية تجمع ما بين التعليم، والبحوث والعلوم، والتنمية المجتمعية.

تأسست مؤسسة قطر في عام 1995 بناء على رؤية حكيمة تشاركها صاحب السمو الأمير الوالد الشيخ حمد بن خليفة آل ثاني وصاحبة السمو الشيخة موزا بنت ناصر تقوم على توفير تعليم نوعي لأبناء قطر. واليوم، يوفر نظام مؤسسة قطر التعليمي الراقي فرص التعلّم مدى الحياة لأفراد المجتمع، بدءاً من سن الستة أشهر وحتى الدكتوراه، لتمكينهم من المنافسة في بيئة عالمية، والمساهمة في تنمية وطنهم.

كما أنشأت مؤسسة قطر صرحًا متعدد التخصصات للابتكار في قطر، يعمل فيه الباحثون المحليون على مجابهة التحديات الوطنية والعالمية الملحة. وعبر نشر ثقافة التعلّم مدى الحياة، وتحفيز المشاركة المجتمعية في برامج تدعم الثقافة القطرية، تُمكّن مؤسسة قطر المجتمع المحلي، وتساهم في بناء عالم أفضل.

للاطلاع على مبادرات مؤسسة قطر ومشاريعها، يُرجى زيارة الموقع الإلكتروني http://www.qf.org.qa

Investments in Saudi’s key sectors to hit $1trln by 2030 – Goldman Sachs

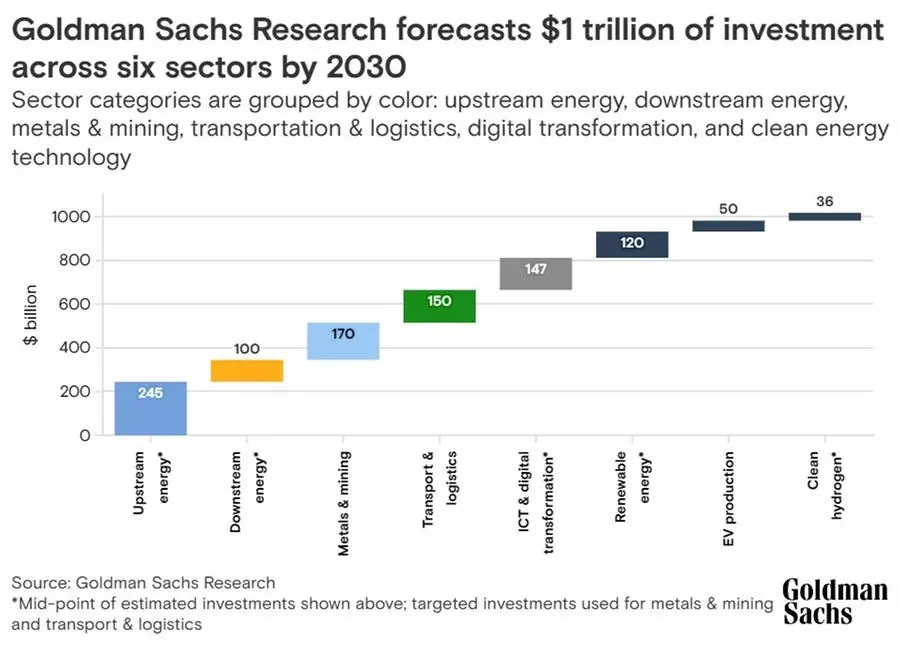

01 Nov 2023 Written by Admin AdminAround $1 trillion worth of preliminary investments will pour into Saudi Arabia’s six key sectors by 2030, as the kingdom implements a wave of reforms to transform its economy, according to Goldman Sachs Research.

Of the estimated investments, which are part of the $3.3 trillion targeted by the kingdom’s National Investment Strategy (NIS), $245 billion will be spent on upstream energy, while $100 billion and $170 billion will go to downstream energy, and metals and mining, analysts at the global investment banking said.

The transport and logistics sector will see around $150 billion, while total investments in ICT and digital transformation will reach $147 billion. Renewable energy, EV production and clean hydrogen will see investments reach around $120 billion, $50 billion and $36 billion, respectively, through the end of the decade.

The said sectors are already benefiting from increased investment, Goldman Sachs noted, adding that they are likely to drive a “capex supercycle” through the end of the decade.

“Within six strategic sectors, we see scope for nearly $1 trillion in preliminary investments through the end of the decade across investment programs, with more projects to be announced in tandem with technological progress and as Saudi accelerates execution of mega-projects and smart cities,” wrote Goldman Sachs Research analyst Faisal AlAzmeh in a team report.

In one of its latest briefings, Goldman Sachs noted that Saudi Arabia’s focus on diversifying its economy is already showing results.

The kingdom launched NIS in 2021 as a crucial enabler for achieving Vision 2030, the government’s blueprint for economic transformation. Its focus is to strengthen the role of foreign direct investment (FDI), which is expected to grow to 3.4% of GDP by 2025 and 5.7% by 2030.

A key pillar of the NIS is Shareek, a 2021 program that seeks to expand domestic investment made by private sector businesses to $1.3 trillion by 2030.

Some of the plans to boost investments

Among the sectors in focus, Saudi’s clean technology is set to see additional 60 gigawatts of renewable energy capacity and two to three GW of nuclear energy capacity by 2030.

In metals and mining, Saudi Arabia announced a new investment law in 2021 to facilitate the issuance of mining licenses and leverage an estimated $1.3 trillion worth of metals and minerals that are said to be “vastly unexplored”.

To boost its transportation and logistics sector, Saudi launched recently an updated National Transport and Logistics Strategy, a Saudi Aviation Strategy and a new national airline. There are also plans to expand the King Salman International Airport.

As for digital transformation, the country’s telecommunications providers are focused on network capacity expansion, particularly 5G and fiber-to-home services.

source: Zawya